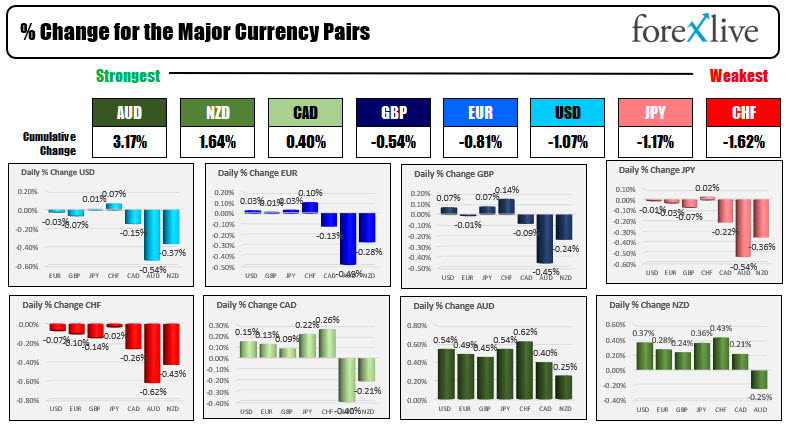

The USD is mostly lower with declines vs the commodity currencies

The AUD is the strongest and the CHF is the weakest as traders prepare for the US jobs report at the bottom of the hour. The USD is mostly lower with declines vs the commodity currencies mostly. The greenback is little changed vs the EUR, GBP, JPY and CHF. The uS stocks in pre-market trading are higher. Yields are little changed.

In other markets, the snapshot shows:

In other markets, the snapshot shows:- Spot gold is up $6.95 or 0.39% $1815.15.

- Spot silver is up $0.20 or 0.90% $24.10

- WTI crude oil futures are up $0.24 or 0.34% $70.23

- the price of bitcoin is back above the $50,000 level at $50,232, up $957 on the day

In the premarket for US stocks, the futures are implying a modestly higher opening after yesterday’s gains. The Dow broke a three-day losing streak yesterday. The S&P and NASDAQ posts a record closes and are adding to those gains today (at least so far)

- Dow +34 points

- S&P up 6.5 points

- NASDAQ up 19 point

In the European markets, the major indices are trading mixed:

- German DAX, +0.1%

- France’s CAC, -0.4%

- UK’s FTSE 100 +0.2%

- Spain’s Ibex -0.4%

- Italy’s FTSE MIB unchanged

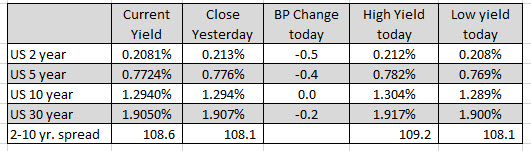

In the US debt market, yields are little changed:

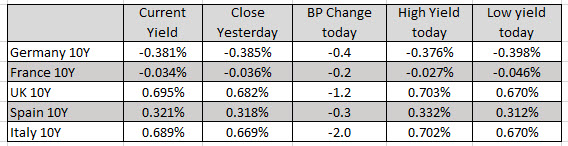

In the European debt market, the 10 year benchmark yields are lower with the 10 yield down -2.0 basis points.