The Australia ASX200 is opening higher with a gain of 0.96% at 7348.30.

Looking at the daily chart, the index moved up yesterday to test the 100/200 day MAs at 7280 and 7333.2 respectively. However, the price could not sustain momentum above the higher 200 hour moving average (green line) and rotated back to the downside into the close.

With the higher opening and the price trading at 7348.30, the index has extended above the 200 day moving average at least in early trading. That gives the buyers more control. If the price can stay above, it would have traders thinking about taking a run toward the all-time highs from 2021 and early 2022 near the 7620 – 7632 area.

Meanwhile crude oil futures are up about a dollar at $113.12 a barrel.

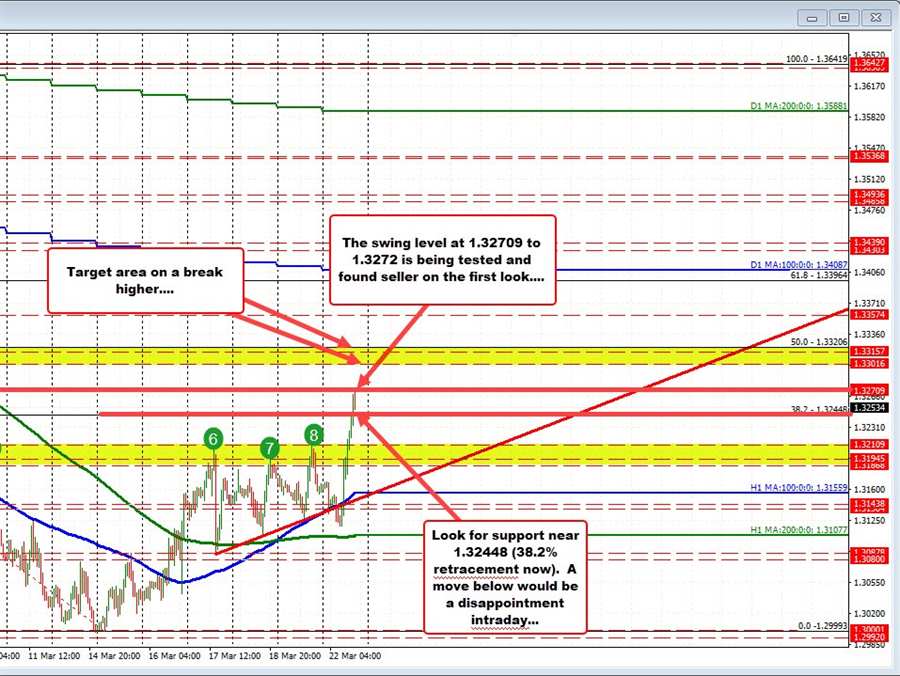

/ AUDUSD