The central bank is expected to increase rates to 0.5% from 0.25%

The NZDUSD is down modestly on the day but stalling near its 100/200 hour moving averages around the 0.7020 area (see blue and green lines in the chart below).

Technically, the price remains below a downward sloping topside trendline on the hourly chart that cuts across at 0.7045 currently (and moving lower), and above an upward sloping trendline on the same hourly chart at 0.7007. Traders will be looking for a break outside of those trendlines to determine the next move (higher or lower)

The move to the downside today comes despite high expectations that the Reserve Bank of New Zealand will raise the OCR interest rates to 0.5% from 0.25% when they announce their rate decision on Wednesday (August 18).

The New Zealand economy has seen GDP rebound and surpass pre-pandemic levels. The GDP growth is currently coming in at 2.4% year on year versus 1.8% pre-pandemic. The number of employed is above pre-pandemic levels , and the unemployment rate is equal to the pre-pandemic level of 4.0%. Inflation is higher at 3.3% versus 1.9% and could be more permanent versus transient. Finally, house prices continue to be in bubble like territory with a gain of 25% over the last 12 months.

Having said that, The rate hike is fully priced in.

However traders will be focused on the forward guidance from the RBNZ. The rate path in May 2021 from the RBNz was forecasting no rate hikes before 2H22.

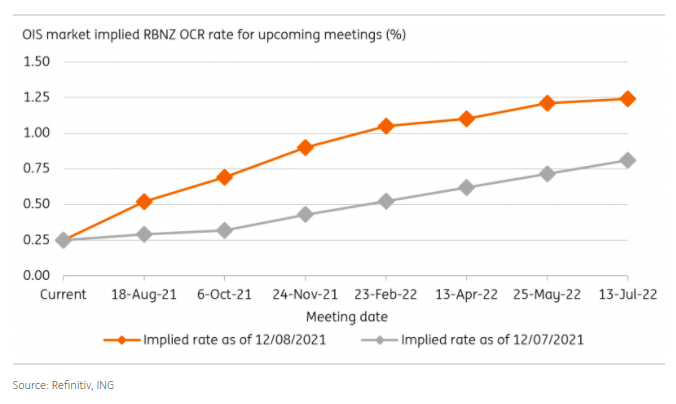

Looking at the implied OCR rate for upcoming meetings from the OIS market, the expectations are for the rate to rise to 1.25% by July 2022. That’s up from a projected rate of 0.8% just a month ago.

What will the RBNZ expect? That will be the focus from traders. Until then, traders may look to stay within the trend lines (and trade around the MAs as well), until the picture becomes more clear on Wednesday.