NZD/USD is up 0.2% on the day, contesting its 100-day moving average

From a technical perspective, the pair is running into a bit of a critical juncture at this stage as price tests the 100-day moving average (red line) @ 0.7081 and is closing in on the highs since late June close to 0.7090-05.

The 200-day moving average (blue line) is also seen nearby @ 0.7112 and that adds to the resistance region for buyers at the moment.

Keep below the levels highlighted and sellers are still able to stay in the game but break above and we could see fresh momentum in securing the next leg higher for the pair.

From a fundamental perspective, there are good arguments for the push higher to extend as well. The virus situation in New Zealand looks to be kept under control and that sees the RBNZ back on track to potentially hike 50 bps next month.

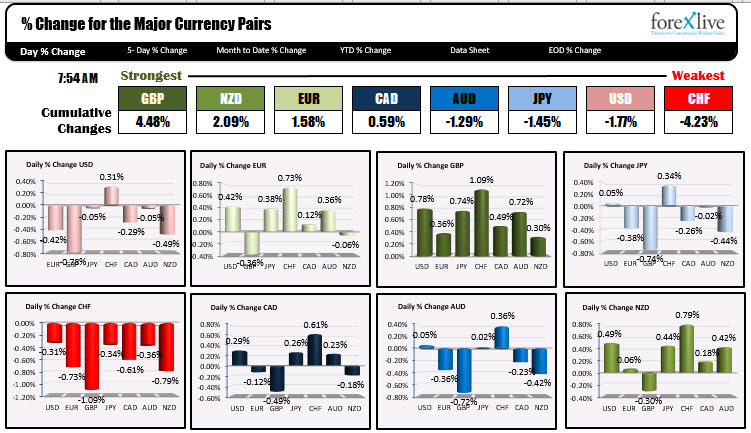

Meanwhile, the dollar is floundering a little post-Jackson Hole and there are fears that tomorrow’s jobs report may come in more underwhelming than anticipated.

As we look towards the end of the week, the technicals and the US non-farm payrolls release are going to be the key things to watch for – in particular, the latter. That will set the tone for what to expect next in NZD/USD as we run into key resistance on the week.