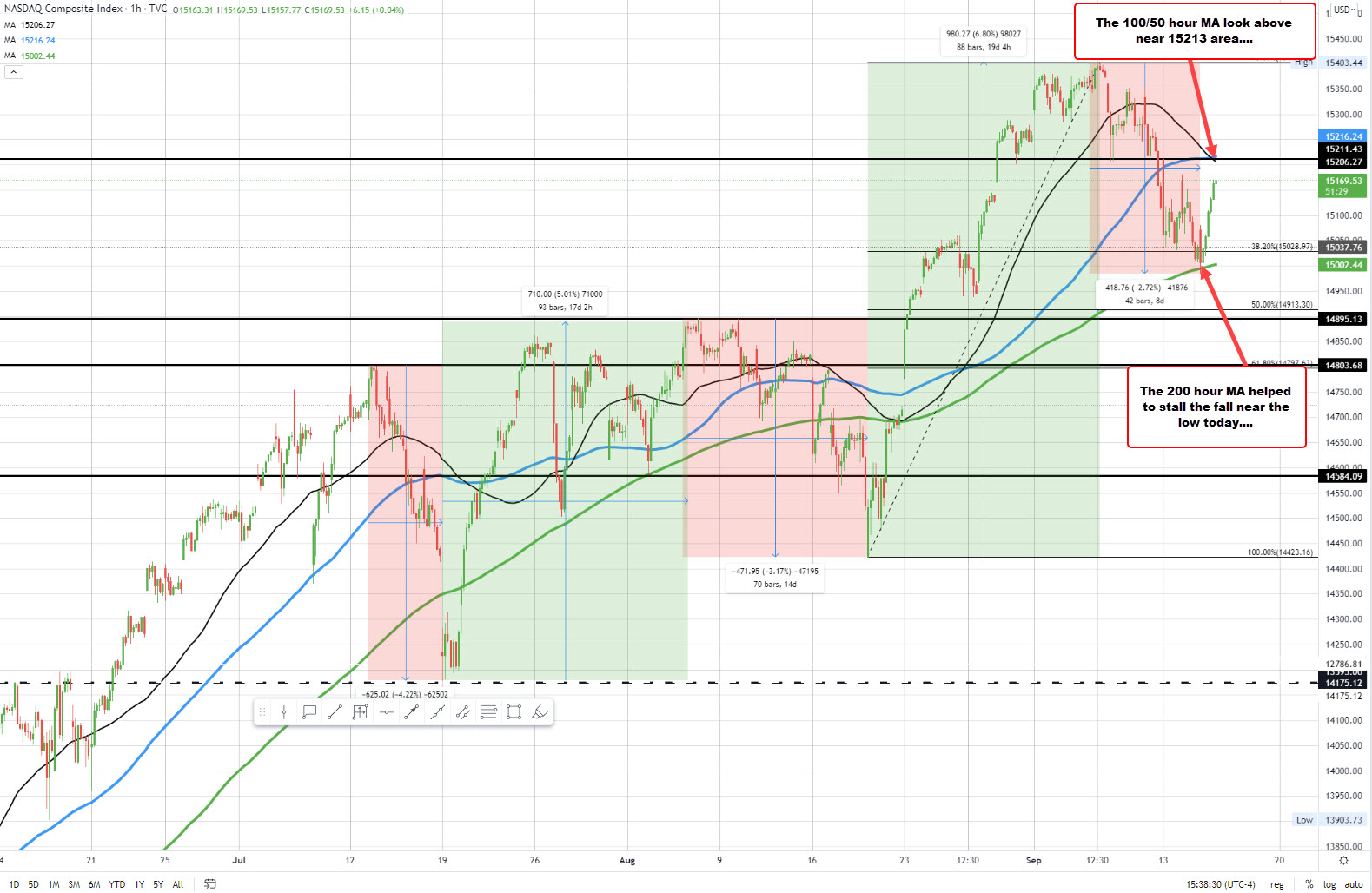

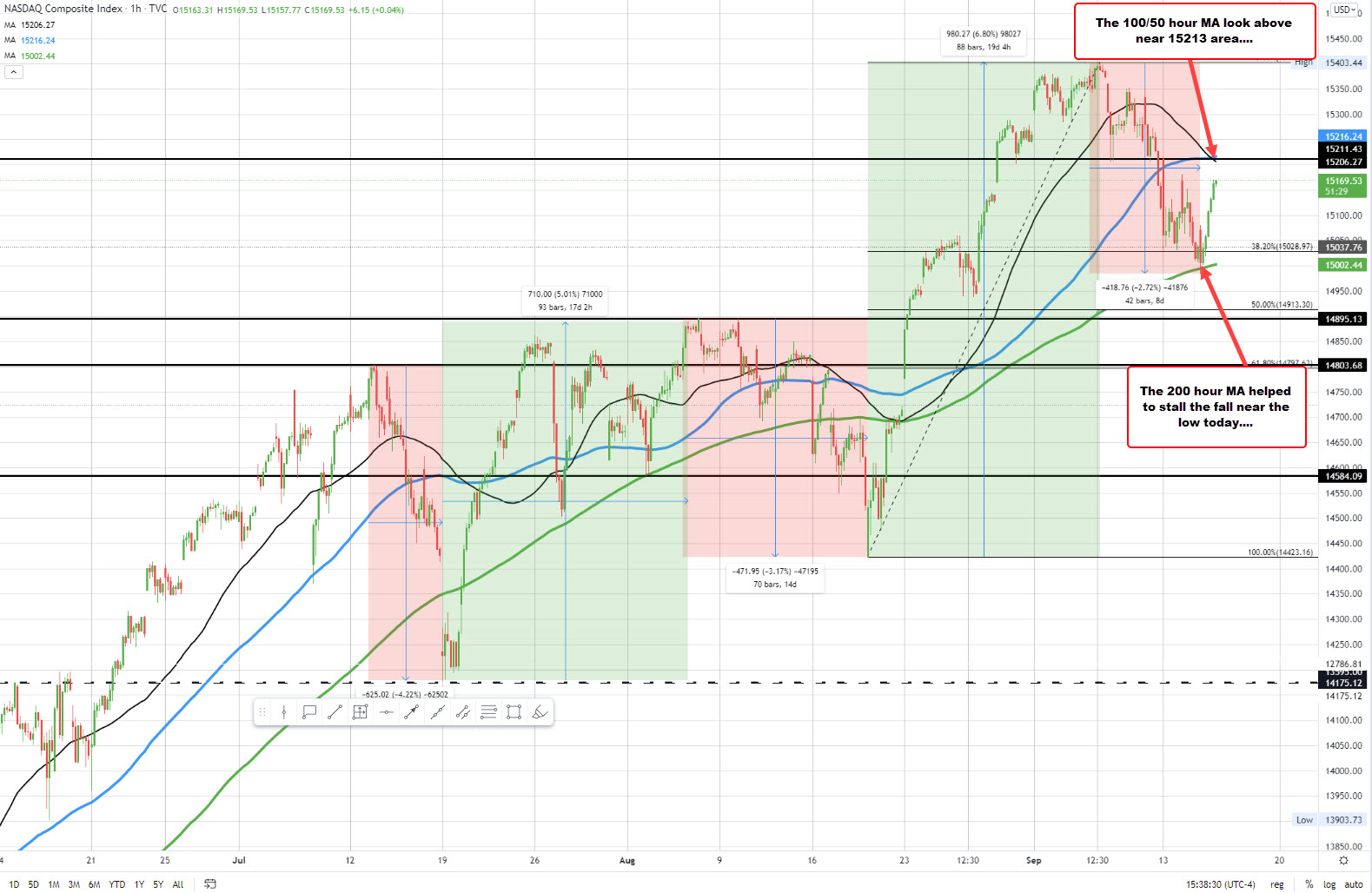

Bounces off 200 hour MA

The NASDAQ index is on pace with less than a half-hour ago, to snap it’s five day losing streak. The S&P index and Dow industrial average which were down five the last six trading days coming into today, will have pundits saying each are up two of the last three days with both gaining in trading today.

The NASDAQ index is currently up 135 points or 0.90% 15172.90. Looking at the hourly chart, the price moved down to test its 200 hour moving average (green line) earlier in the day and found interested buyers. On the topside, the falling 50 hour moving average and flat 100 hour moving average come in near 15213 area. If the buyers are to take more control, getting above those levels would be the next step.

For the Dow industrial average, it is currently up 274 points or 0.8% at 34852.50.