Understanding the London Forex Session

The foreign exchange market, or forex market, is a global marketplace for exchanging national currencies. Among the various trading sessions, the London session holds a significant position due to the sheer volume of trades and the market’s influence on currency movements. Understanding the London Forex Session is crucial for traders aiming to optimize their strategies and capitalize on the market’s volatility.

Key Characteristics of London Trading Hours

The London session is known for its unique characteristics, which distinguish it from other sessions:

- High Liquidity: The London session is one of the most liquid sessions, enabling traders to execute large trades with minimal market impact.

- Increased Volatility: This session often experiences significant price movements, offering opportunities for traders to profit from rapid changes in currency values.

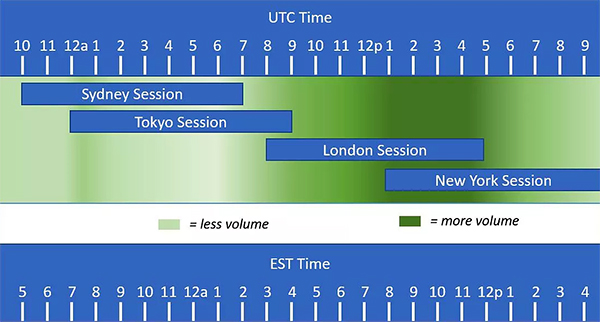

- Overlap with Other Sessions: The London session overlaps with both the Asian and New York sessions, leading to heightened activity as traders from different regions participate simultaneously.

Market Opening: London Session Timings

The London forex session operates on Greenwich Mean Time (GMT) and typically runs from 8:00 AM to 4:00 PM GMT. However, it’s important to note that this can vary slightly depending on daylight saving time changes. During these hours, the forex market experiences increased trading volumes as European financial hubs become active.

Example:

- During Standard Time: The London session runs from 8:00 AM to 4:00 PM GMT.

- During Daylight Saving Time: The session shifts to 7:00 AM to 3:00 PM GMT.

Major Currency Pairs in the London Session

Several major currency pairs are actively traded during the London session, due to the presence of globally significant financial centers and multinational corporations. These currency pairs include:

- EUR/USD: The Euro against the United States Dollar is the most traded pair during the London session.

- GBP/USD: The British Pound against the United States Dollar is another highly active pair, reflecting the UK’s economic significance.

- USD/CHF: The US Dollar against the Swiss Franc is often traded as Switzerland’s markets are also active during this time.

London Session Strategies for Forex Traders

Successful trading in the London session requires strategic planning and execution. Here are some strategies that traders often employ:

- Breakout Trading: Given the volatility during the London session, traders often look for price breakouts from previous ranges. This strategy involves entering trades when prices break through established support or resistance levels.

- Trend Following: Traders can capitalize on the strong trends that often develop during the London session. This strategy involves identifying and following the prevailing market trend, whether bullish or bearish.

- Range Trading: During times of lower volatility or when the market is consolidating, traders might focus on range trading by buying at support and selling at resistance levels within a defined price range.

Comparing London with Other Forex Sessions

Below is a comparative table highlighting the main characteristics of the London session in relation to other major forex sessions.

| Session | Trading Hours (GMT) | Liquidity | Volatility |

|---|---|---|---|

| London | 8:00 AM – 4:00 PM | High | High |

| New York | 1:00 PM – 9:00 PM | Moderate-High | High |

| Tokyo | 12:00 AM – 9:00 AM | Moderate | Moderate |

| Sydney | 10:00 PM – 7:00 AM | Low-Moderate | Low-Moderate |

Practical Tips:

- Align with Overlaps: The overlaps between the London and New York sessions (1:00 PM to 4:00 PM GMT) often see the highest volatility and liquidity, making it an optimal time for trading.

- Monitor Economic Releases: European economic data releases typically occur during the London session, which can significantly impact currency pairs like EUR/USD and GBP/USD.

In conclusion, the London forex session is a dynamic and vital component of the global forex market. Traders who understand its characteristics, timings, and major currency pairs can develop effective strategies to navigate its unique opportunities and challenges. By leveraging the session’s high liquidity and volatility, traders can improve their chances of achieving profitable outcomes in the forex market.

Leave feedback about this