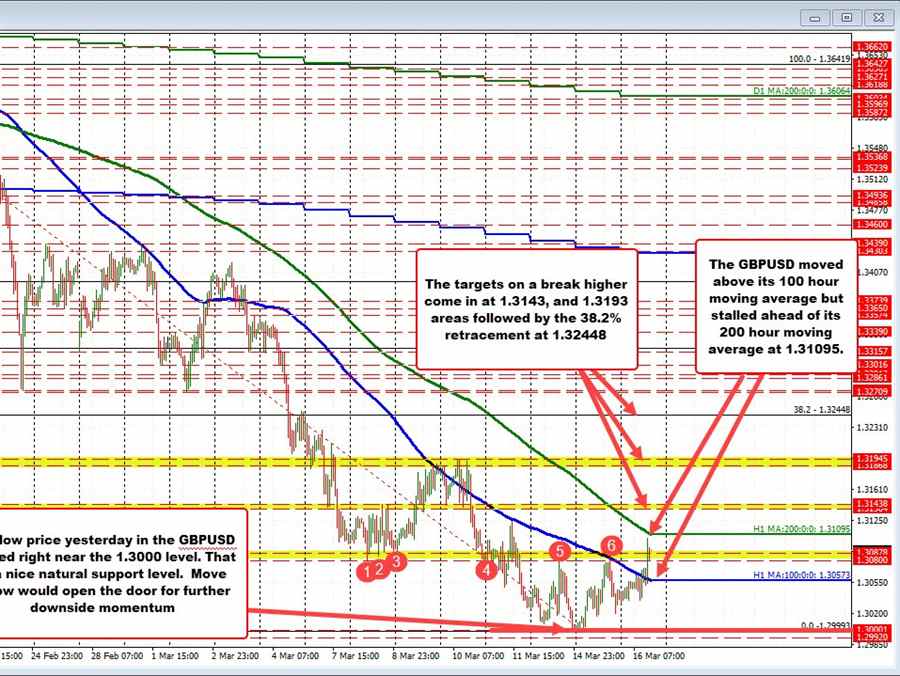

The GBPUSD had found sellers near its 100 hour moving average on the last two tests (see blue line in the chart above). Yesterday the price briefly traded above the level but also ran into swing area resistance between 1.3080 and 1.30878 (see post from yesterday HERE). The price backed off into the close.

Today, the buyers pushed up toward the falling 100 hour moving average again and was able to sneak through the falling moving average line (currently at 1.3058). In the early North American session, the price moved up to a intraday high of 1.31047. That was just short of the falling 200 hour moving average currently at 1.31107. The price has not traded above its 200 hour moving average since February 23 when it broke below that moving average at 1.3576 (the 200 hour moving average 465 pips from that level now).

So although one step was taken above the 100 hour moving average and you can argue another step was taken above the swing area at 1.3080 to 1.30878, the next step above the 200 hour moving average 1.31107 has not been able to be taken. A battle between the moving averages is on. Traders will look for the next shove.

That shove may have to wait until the FOMC decision at 2 PM ET.

On a break of the 100 hour moving average, recall the low from yesterday stalled right around the natural support at 1.3000. The low price reached 1.29993 (close enough). On the topside, a break of the 200 hour moving average would next target 1.3143 area. Swing lows and highs come in near that level. Above that would be the highs from last Wednesday and Thursday between 1.3188 and 1.31945. Back above that and the 38.2% retracement of the move down from the February 18 high comes in at 1.32448.