The foreign exchange (Forex) market is one of the most dynamic and liquid financial markets globally. Traders, whether novice or experienced, must understand the risks associated with Forex trading to ensure they protect their investments effectively. A Forex risk calculator is an essential tool for managing these risks. This article delves into the intricacies of Forex risk calculators, offering insights into their functions and benefits, and providing expert tips on how to use them effectively.

Understanding the Basics of Forex Risk

Forex trading involves exchanging one currency for another, with the goal of making a profit from the fluctuations in exchange rates. However, due to the volatile nature of the Forex market, traders face substantial risks. These risks can include market volatility, leverage risks, and unexpected geopolitical events. Understanding these risks is crucial, as it enables traders to implement strategies that minimize potential losses while maximizing gains.

Why Use a Forex Risk Calculator?

A Forex risk calculator is a tool that helps traders manage their risk exposure by calculating the potential loss or gain from a trade based on various input factors. Using a risk calculator offers several advantages:

- Precision: It provides accurate risk assessments, enabling traders to make informed decisions.

- Efficiency: Saves time by quickly calculating potential risks and rewards.

- Risk Management: Helps in setting stop-loss and take-profit levels to ensure trades align with a trader’s risk appetite.

- Consistency: Ensures systematic risk assessment across multiple trades.

Key Features of a Forex Risk Calculator

When utilizing a Forex risk calculator, traders can expect several key features that assist in effective risk management:

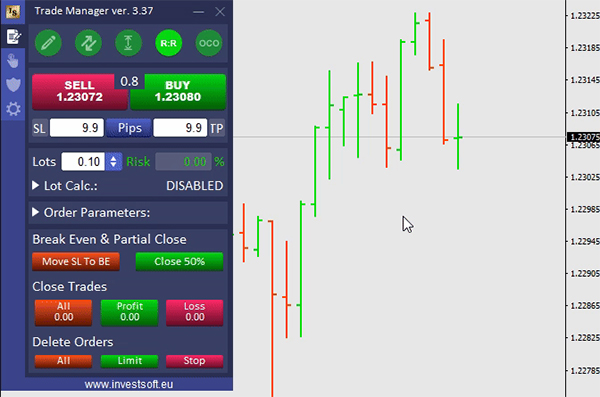

- Trade Size Calculation: Determines the appropriate trade size based on account balance and risk percentage.

- Stop-Loss Calculation: Calculates the optimal stop-loss level to limit potential losses.

- Risk-Reward Ratio: Assesses the potential reward compared to the risk taken, aiding in better decision-making.

- Currency Pair Selection: Offers options to calculate risks for different currency pairs, accounting for varying volatility levels.

- Leverage Impact: Shows how leverage affects potential gains and losses, helping traders understand leverage-related risks.

How to Effectively Use the Calculator

To maximize the benefits of a Forex risk calculator, follow these steps:

- Input Accurate Data: Enter the account balance, currency pair, and risk percentage accurately into the calculator.

- Set Realistic Risk Levels: Decide on a risk percentage that aligns with your overall trading strategy. Typically, it’s advisable to risk no more than 1-2% of your total account balance on a single trade.

- Analyze the Output: Use the calculator’s output to set appropriate trade sizes and stop-loss levels. Ensure that the risk-reward ratio justifies entering the trade.

- Regular Updates: Reassess your risk calculations regularly, especially when market conditions change or your account balance significantly fluctuates.

Common Mistakes and How to Avoid Them

Even with a Forex risk calculator, traders can make errors that compromise their trading strategies. Here are some common mistakes and how to avoid them:

- Over-Leverage: Avoid excessive leverage by understanding its impact on risk exposure. Stick to leverage levels you are comfortable managing.

- Ignoring Market Conditions: Always consider current market volatility and events that might affect your trades. Adjust your risk calculations accordingly.

- Inconsistent Application: Apply the risk calculator consistently to all trades to maintain a uniform risk management approach.

Choosing the Right Forex Risk Calculator

Selecting the right Forex risk calculator is crucial for effective risk management. Consider the following factors:

- User Interface: Look for calculators with a user-friendly interface that simplifies data entry and interpretation.

- Customization Options: Choose a calculator that allows for customization based on your trading preferences and goals.

- Compatibility: Ensure the calculator is compatible with your trading platform and devices.

- Reliability and Support: Opt for calculators from reputable providers that offer customer support and regular updates.

| Feature/Factor | Importance | Example Tools | Consideration Points |

|---|---|---|---|

| User Interface | High | Myfxbook, Babypips | Ease of use, intuitive design |

| Customization Options | Moderate to High | ForexTester, MetaTrader | Tailored inputs, versatile use |

| Compatibility | High | MT4/MT5 Plugins | Device/platform compatibility |

| Reliability and Support | High | TradingView, OANDA | Provider reputation, support |

In conclusion, a Forex risk calculator is an indispensable tool for any trader looking to navigate the complexities of the Forex market responsibly. By understanding its features and using it effectively, traders can manage their risk exposure and make more informed trading decisions. Remember, the key to successful Forex trading lies not only in the potential rewards but also in robust risk management practices.

Leave feedback about this