Range for the week is only 63 pips as summer doldrums dominate

The EURUSD is trading to a new session high and in the process is testing the high price from Monday’s trade at 1.17684. The low for the week was reached on Wednesday (around midday too). The low to high trading ranges is only about 63 pips which is the most narrow since Thanksgiving week in November 2019. There is room to roam.

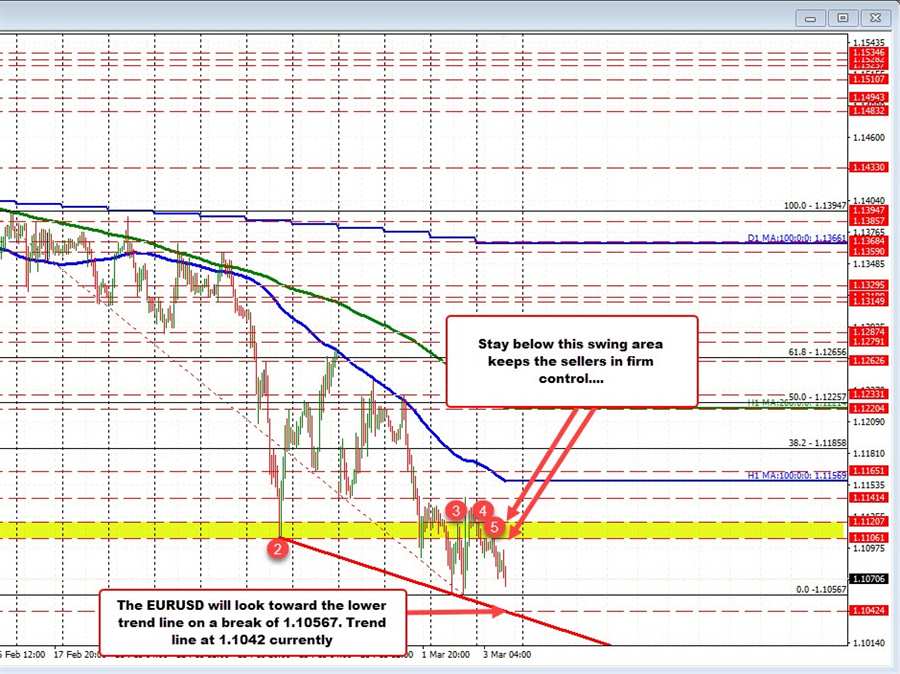

Looking at the hourly chart, there is a swing area between the 1.17684 and I.17708 level (see yellow area and red numbered circles). Break above that and traders will be eyeing the 38.2% retracement of the range since the July high and the falling 200 hour moving average. Both come around the 1.1782 area.

The price action over the last few days has seen the price try to get above its 100 hour moving average (blue line in the all chart below). Today, the early Asian session high stalled near a swing high from Tuesday’s trade in a swing high from late yesterday’s trading near 1.17416. After a another fail below the 100 hour moving average, the price broke above that 1.17416 level followed by a break above a swing area between 1.1751 and 1.17566. Sellers gave up, and buyers have pushed the price higher in the early New York session.

True to the non-trending nature the week, however, sellers have also leaned against the Monday high because they can define risk and limit risk against the level (and why not…the market is non-trending). Of course a break above should solicit more buying however.

Buyers who like the pair would not want to see the price move back below the broken swing area between 1.1751 and 1.17566. That just would not sit well. Sellers who sold against the old high, meanwhile, would love to see the double top remain and the prices move back down toward the 1.17416 and maybe even the 100 hour MA.

The key levels for both? The high for the week, and the swing area with the low at 1.1751.

PS As a reminder….the low for the week bottomed at 1.17053. The low for the year from the end of March bottomed at 1.17035.