Bears hold the advantage

The EURUSD trades lower and the sellers hold the intermediate bias from a technical perspective as the week gets underway.

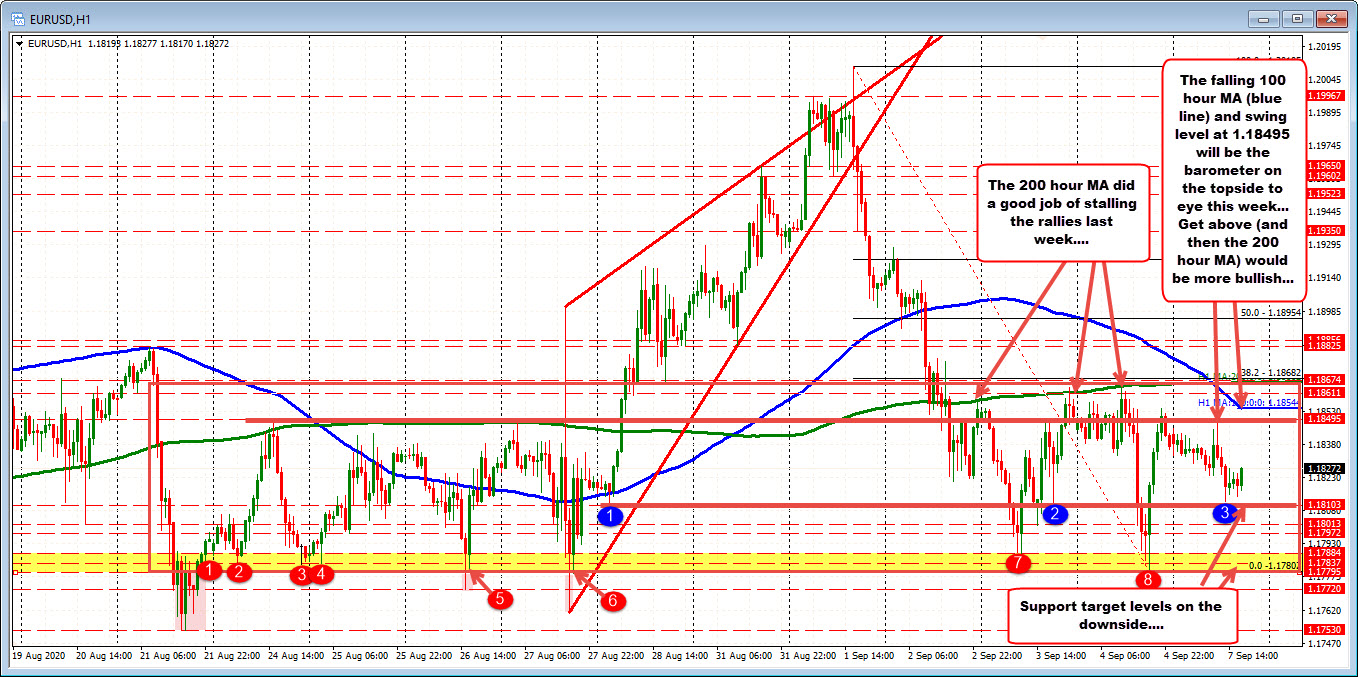

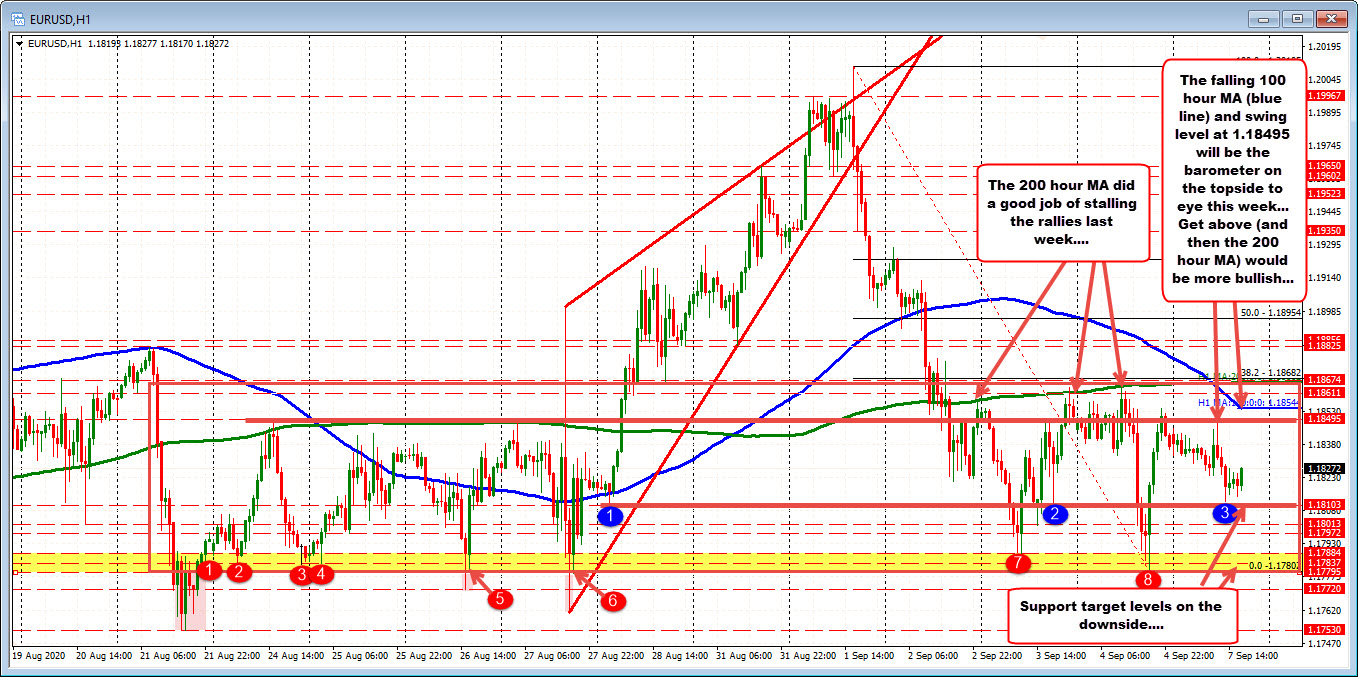

Looking at the hourly chart below, the price last week moved lower after peaking and failing near the key 1.2000 level. The high price spiked to 1.2010 on Tuesday before quickly turning around and stepping lower.

The price fell below its 200 hour moving average on Wednesday, and for the most part stayed below that moving average for the rest of the week. It did test the line on Wednesday near the close and again on Thursday near the close. On Friday the high price in the London session – before the release of the US jobs report – also stalled right at that moving average line (see green line in the chart below).

The 200 hour moving average remains a key barometer for bulls and bears in the new trading week. Staying below keeps the bears more in control from at least a intermediate term prospective. The falling 100 hour moving average (blue line in the chart above) at 1.18544 currently is also a barometer for buyers and sellers as is the swing level at 1.18495. Recall that level was the swing high from August 24 and August 27. Today the high price also stalled just ahead of that level.

In the new trading week getting above 1.18495, the falling 100 hour moving average at 1.18544 and finally the 200 hour moving average at 1.18674 currently would swing the intermediate bias back to the upside. Failure to do that and the sellers are more control.

Not is all bearish however. The low price last week stalled near swing lows from August 26 and August 27 near the 1.1780 level. The area between 1.1780 and 1.17884 represents a swing area that would need to be broken – and stay broken – for the sellers to take more control.

Note, that the price action in the pair has seen extremes below the low of that area back on August 21, August 26 and again on August 27 (see red shaded area in the chart above). However momentum could not be sustained and the price action moved back into the more “comfortable value area” (before breaking higher).

The current price trades between the upper resistance area between 1.1849 at 1.1867 and the lower support area between 1.1780 and 1.1788. The price trades at 1.1827 currently. The low for today reached just above a swing low from Thursday and again on August 28 at 1.18103. That level will be eyed as a closer support barometer for buyers and sellers. Move below and it should solicit more downward momentum toward the lower extremes.

The battle is on in the new trading week, with the levels defined.