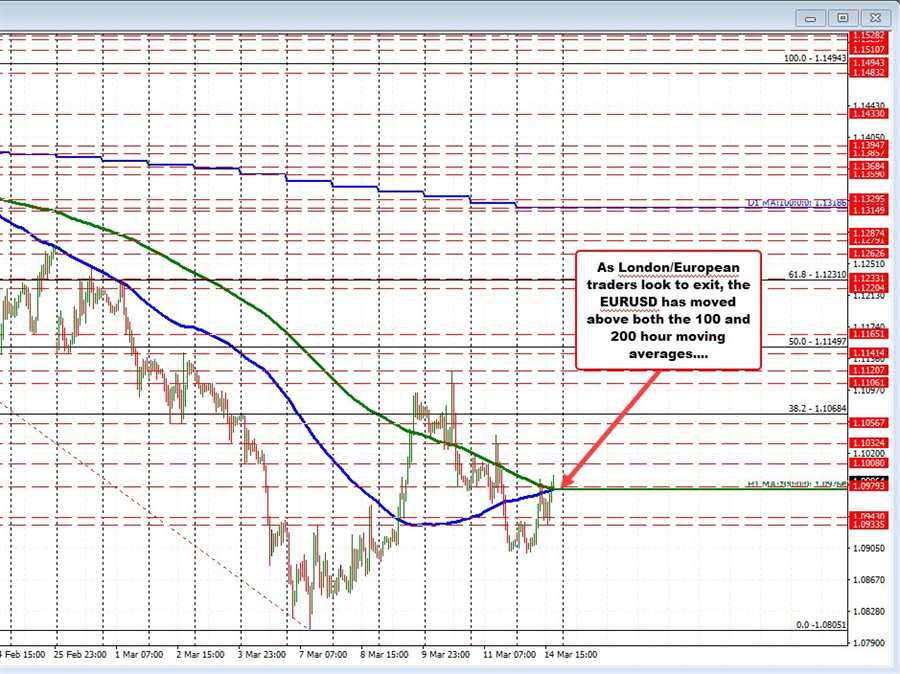

The EURUSD fell below the 100 hour MA on Friday but stalled ahead of its 200 hour MA. On Wednesday of last week after moving below its 100 hour MA on two separate occasions, the price fall stalled near the 200 hour MA.

Guess what?

The price is retesting the 200 hour MA at 1.10103. The price is trading at 1.1015. The low just reached 1.10126. Can the sellers push below the level and tilt the buying back to selling?

ON a break, there is a upward sloping trend line at 1.10023. Below that and the broken 38.2% of the move down from the Feb 25 swing high cuts across at 1.0984, followed by the swing low from March 15 at 1.0924 and then another swing area at 1.0899 (call it 1.0900).

In favor the downside is the sharp rise in US rates and the expectations for US rates moving higher in relation to European rates. That should be supportive of the USD (lower EURUSD) but price action is just as important. If the price can not get and stay below the 200 hour MA, the sellers are not showing they love the downside story – no matter what it is.

So get below and stay below and the bears can add.

Stay above and move back above the 100 hour MA and the buyers continue to keep control despite the dips lower.