The headline news that Russia proposes a delegation meeting with Ukrainian officials sent US stocks into positive territory and the EURUSD higher as well.

It is certainly an overture, but comes after surrounding the capitol city of Kyiv with troops and engaging in military action. Reports that the Ukraine land forces are imposing their own victories is favorable, but Putin is likely not ready to step back. I would expect he would ask to take over the government. At which point, the rubber will meet the road. I would not think that NATO- and Ukraine as well – would agree on a hand over.

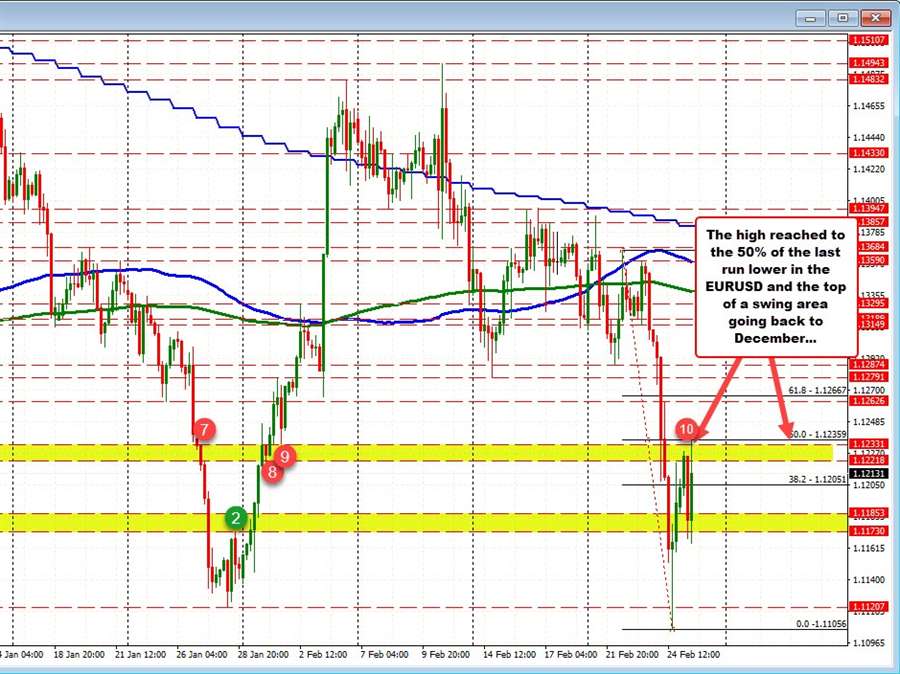

Anyway, the EURUSD moved up from around 1.1185 to 1.1236. At the high the pair tested the 50% of the last run lower in the pair (from Tuesday’s high. It also tested the high swing level from levels going back to December on the 4-hour chart above. Sellers have leaned and the price is trading back to 1.1214.

On the downside today, continue to watch the 1.1173 to 1.1185. That area includes the low from 2021 at 1.11853 and a swing high from January 28 after the price broke below the 2021 low and corrected higher. On January 31 the price moved back above that area and did not breach it again until yesterday’s trading. Move below would be needed to increase the bearish bias again.