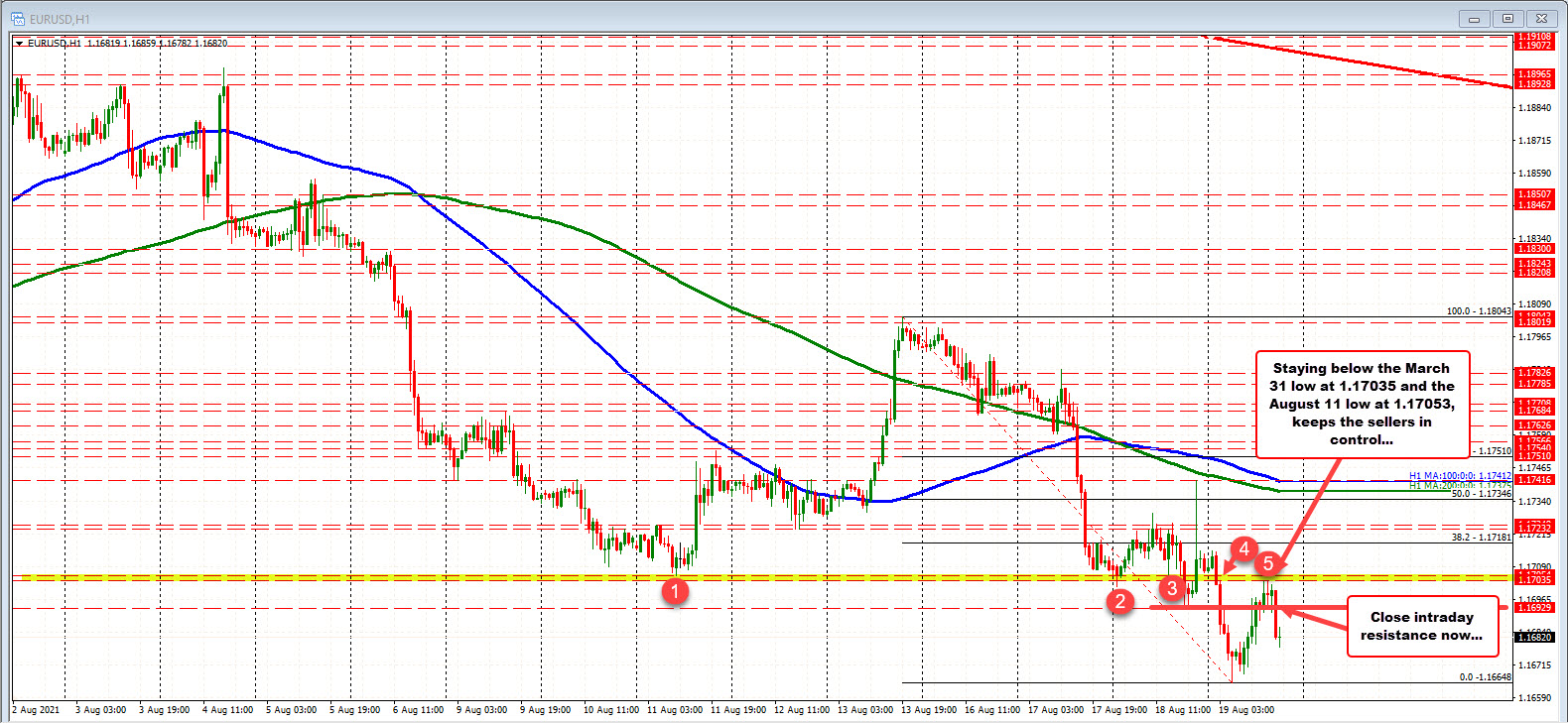

The pair corrective high stalled ahead of the lows between 1.17035 and 1.17053

Recall from last week, the price moved down to a low of 1.17055 and found support buyers. Yesterday there were two attempts to move below that area (the second one was before the FOMC meeting minutes). Those breaks failed.

“Technically, if the price can remain below those old lows (i.e., the 2021 lows between 1.17035 to 1.17053), it is keeps the bears happy and in control A move above, and the break is the 3rd failed break in the past two days and should lead to disappointment buying by the sellers (and new dip buying).

Key test to start the early North American trading.”

Holding below the levels on the correction was key for the sellers/bearish bias today.

The current price is trading at 1.16807. The low for the day reach 1.16648. The low price from yesterday (before the FOMC meeting minutes) reached 1.16929. Watch that level now for close resistance. Stay below keeps the sellers in firm control intraday.

More conservative sellers would still to the price moved back above the 1.17035 to

1.17053 area.