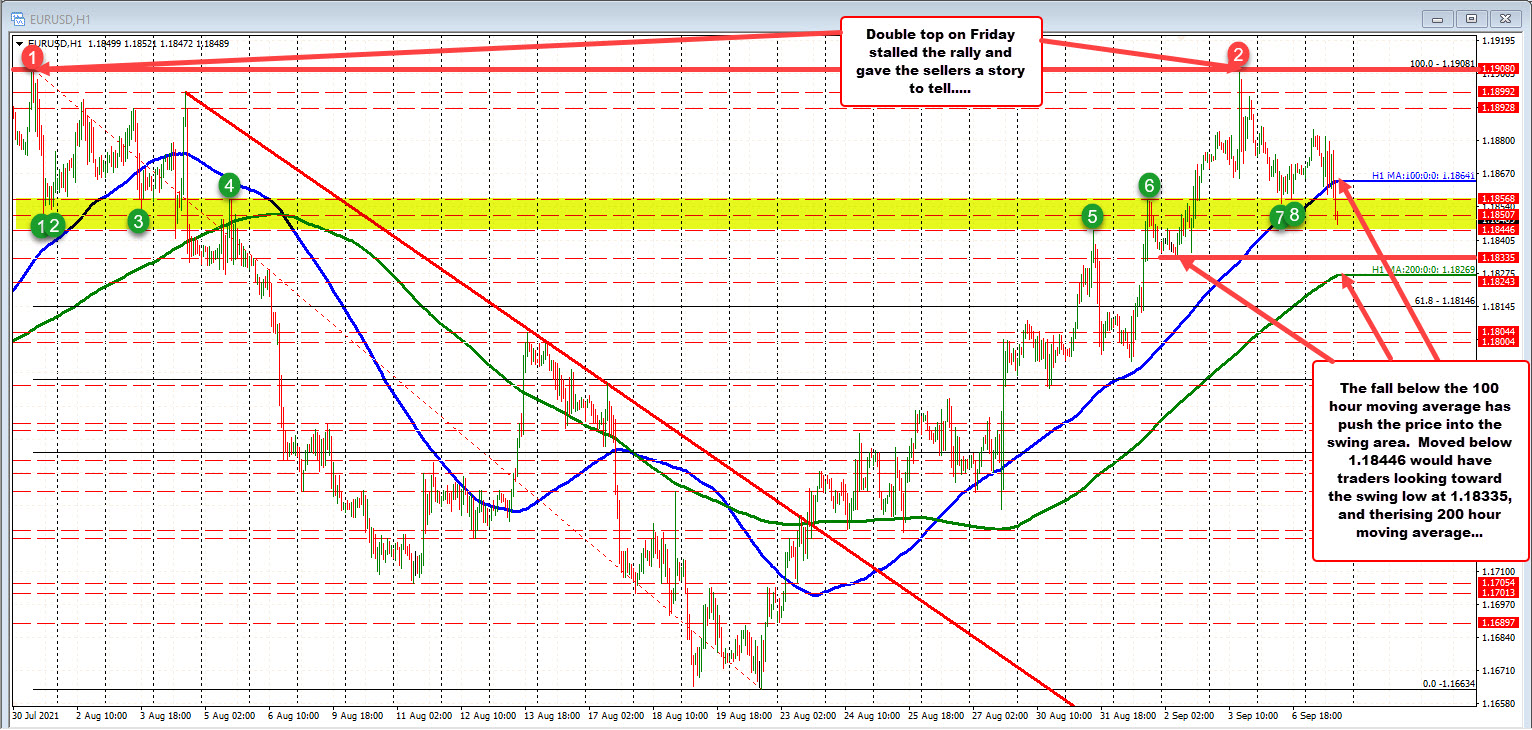

Cracks below the 100 hour MA

The EURUSD is trading to a new session low as dollar buying is being helped by higher yields today. The US 10 year yield is up about 5 basis points after the long Labor Day weekend.

Technically, the EURUSD pair has now fallen below and away from its 100 hour moving average 1.18639 (blue line), after testing the level earlier today and finding some buyers.

The chink in the bullish armor started on Friday after the pair stalled near the high from July 30 at 1.1908 area.

That double top gave the sellers something to lean against (and gave sellers a technical story to tell). The price had been up 10 of 11 days from the low on August 20. That trend-like move gave sellers little to talk about. The double top, however, helped to change that narrative

Yesterday, the price action saw further momentum to the downside, and away from the ceiling, and is being followed by a lower day today (two down days in a row). It will now take a move back above the 100 hour moving average at 1.18641 to change the bearish story in the short term.

On the downside, the swing high going back to August 31 cuts across at 1.18446. Below that level, and traders will start to target the September 2 low at 1.18335 followed by the rising 200 hour moving average at 1.18269.

It will be the 200 hour moving average which will be the next key storyline on further selling momentum. If that level can be broken, the technical bias will shift even more to the sell side, and increase the sellers bias.