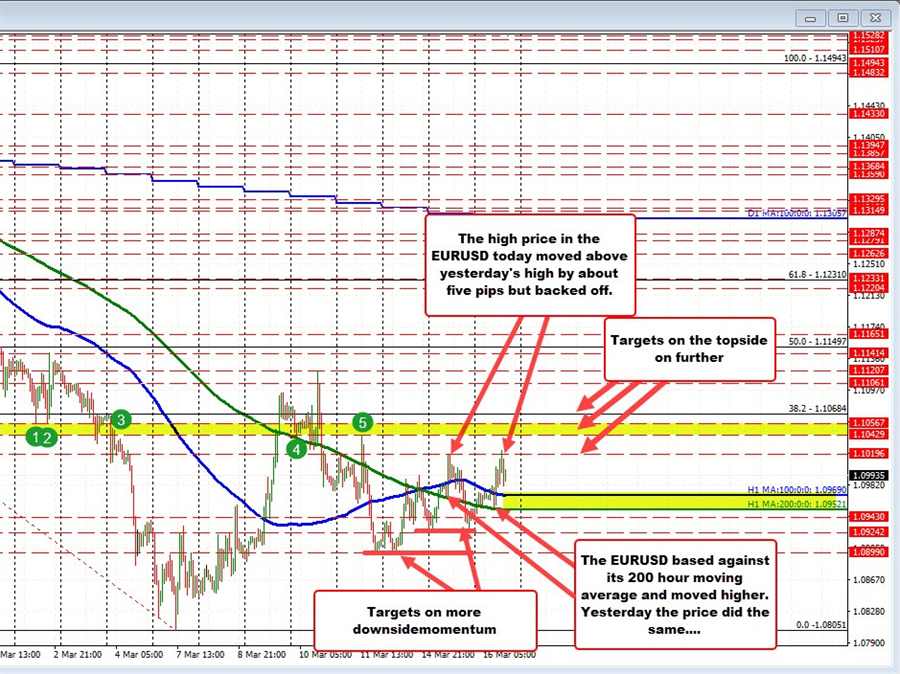

The EURUSD is higher on the day and in the process will back above its 200 and 100 hour moving averages. The good news for the buyers is that a dip to the 200 hour moving average held support and the price moved higher off of that level.

Recall from yesterday, the price action was the same in the early European session with the price bouncing off the 200 hour moving average of moving to a new high at 1.10196. That break ultimately failed into the US close. The high price moved above yesterday’s high price

Today, the high price moved to a new high price for the week to 1.1024, but momentum faded and the price has since moved back down toward the 1.100 area. The price does remain above its 100 hour moving average 1.0969 and the lower 200 hour moving average 1.0952 (the low off of the intraday high has come in at 1.0981 so far).

As a result, the story is similar to yesterday’s story. If the price can hold above the 100 hour moving average and the lower 200 hour moving average, there is hopes for further corrective upside momentum. Upside targets come between 1.10429 and 1.10567 along with the 38.2% retracement of the move down from the February 10 high at 1.10684.

Conversely fall below the 100 hour moving average and then 200 hour moving average would disappoint the buyers and have traders looking toward the swing lows from yesterday near 1.0924 and the swing lows from Friday and Monday near 1.0899