German Dax up 1.9%. UK FTSE 100 up 2.3%.

The major European indices are ending the day with solid gains led by the UK’s FTSE 100.

The provisional closes are showing:

- German DAX, +1.9%

- France’s CAC, +1.7%

- UK’s FTSE 100, +2.3%

- Spain’s Ibex, +1.5%

- Italy’s FTSE MIB, +1.8%

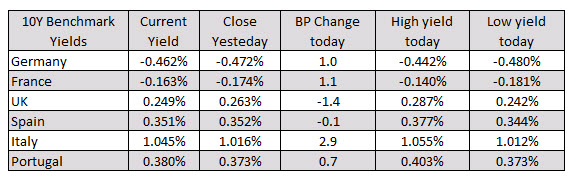

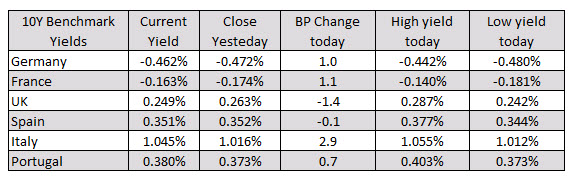

In the European debt market, the benchmark 10 year yields are ending the day mixed results. The UK and Spain yields are down marginally while Germany, France, Italy are marginally higher.

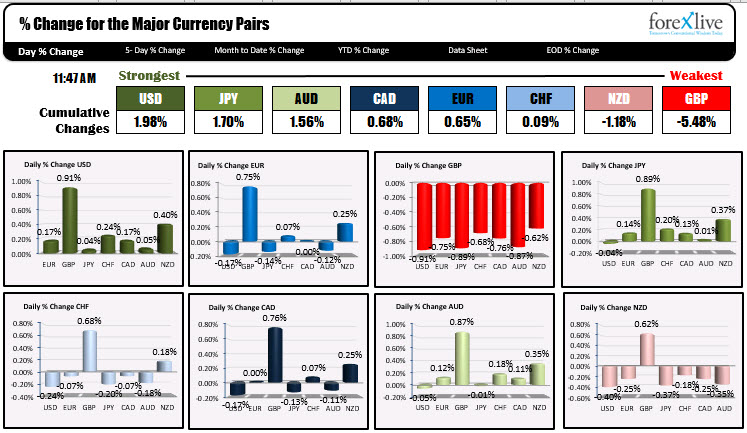

The price action in the major currencies vs. the US dollar has been steady in the London afternoon session. At the start of the session, the changes for the day showed:

The price action in the major currencies vs. the US dollar has been steady in the London afternoon session. At the start of the session, the changes for the day showed:- EURUSD, -13 pips

- GBPUSD, -110 pips

- USDJPY, unchanged

- USDCHF, +6 pips

- USDCAD, +31 pips

- AUDUSD unchanged

- NZDUSD, -20 pips

The current snapshot of the major currencies now shows:

- EURUSD -20 pips. Down 7 pips in the afternoon session

- GBPUSD -119 pips, Down 9 pips in the afternoon session

- USDJPY +4 pips, Up 4 pips in the afternoon session

- USDCHF +21 pips. Up 15 pips in the afternoon session.

- USDCAD +22 pips. Down 9 pips in the afternoon session

- AUDUSD -3 pips. Down 3 pips in the afternoon session

- NZDUSD -26 pips. Down 6 pips in the afternoon session

Not surprisingly, the changes are not that great, but the USD is still marginally higher and it is now the strongest of the major currencies.

In other markets as London/European traders look to exit:

- spot gold is trading down $3.70 or -0.19% $1930.27

- spot silver is trading down 1.3 cents or -0.05% at $26.89

- WTI crude oil futures are trading down $0.72 or -1.81% at $39.05

- E-mini futures are trading up 18.25 points. At the start of the London afternoon session the index was trading up 6.5 points.

Once again the NASDAQ, S&P and Dow industrial average are not trading today. The US debt market is also on holiday in observance of Labor Day.