German DAX, UK FTSE marginally higher. France’s CAC and Spain’s Ibex lower

The major European indices are closing the session with mixed results. Below are the provisional closes:

- German Dax, +0.3%

- France’s CAC, -0.3%

- UK FTSE 100, +0.1%

- Spain’s Ibex, -0.1%

- Italy’s FTSE MIB, Unchanged

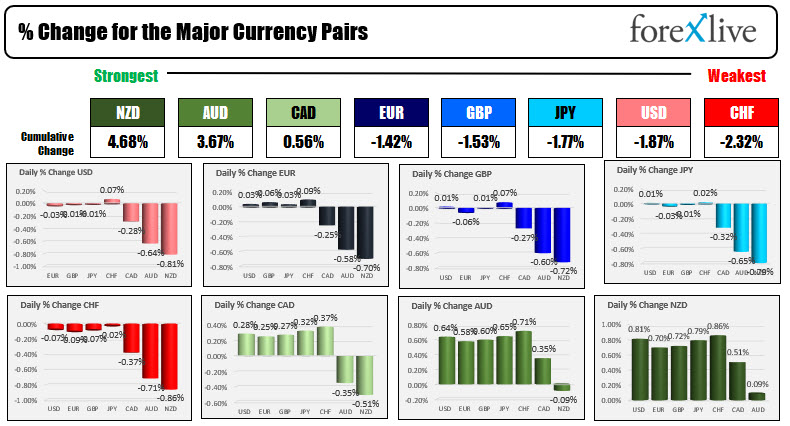

In the forex market as London/European traders look to exit, the NZD remains the strongest, while the CHF is the weakest. Most of the changes vs the USD are focused in the NZD, AUD and CAD (the USD is lower on buying of the commodity/risk currencies).

In other markets:

- Spot gold is is trading up $1.95 or 0.11% at $1806.70.

- Spot silver is up $0.27 or 1.16% $23.84.

- WTI crude oil futures are trading up $1.66 or 2.53% at $67.13

- bitcoin is back below the $50,000 level trading at $48,431.27. That’s down $1130 on the day

In the US stock market, the major indices are higher with both the S&P and NASDAQ index trading to new all-time highs intraday. Recall from yesterday the NASDAQ index did closes at a record level. The S&P all-time high close comes in at 4479.72. The index closed just below that level in trading yesterday:

- Dow Jones up 45.33 points or 0.13% 35381.14

- S&P index up 7.35 points or 0.16% at 4486.83

- NASDAQ index up 52.13 points or 0.35% 14994.70

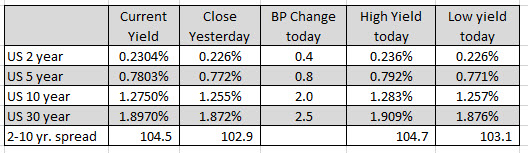

In the US debt market, yields are higher with the 10 year up to basis points and the 30 year up 2.5 basis points.