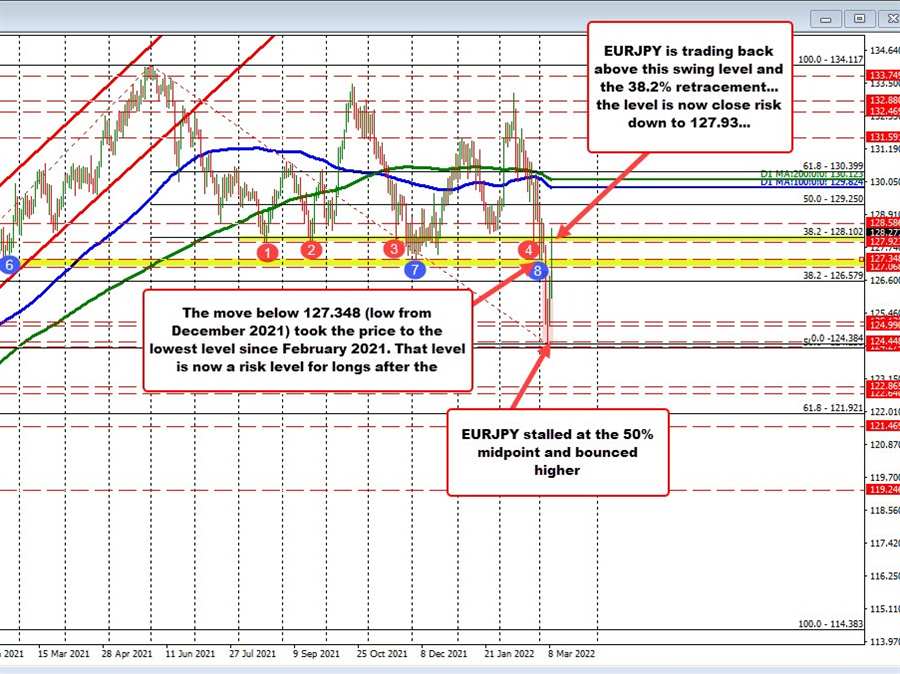

The EURJPY has seen a strong bounce over the last few days, that came after a stronger move to the downside last week that saw the pair move below the December 2021 low at 127.348. That level was the lowest level since February 2021.

The fall below took the price all the way down to 124.384 which was just above the 50% midpoint of the move up from the May 2020 low at 124.250. Staying above the 50% gave something for the buyers to lean against.

The increased risk-on tone seen over the last couple days has helped to propel the market further – especially today.

Today saw the price move back above that December 21 low at 127.348 increasing the bullish technical bias. That momentum has now taken the price also move above the 38.2% retracement of the move down from the 2021 high at 128.102. It also moved above the February low at 127.923. The area between 127.923 and 128.102 is now close risk on the daily chart. The 127.348 swing low from December, is a more conservative risk level on the daily chart.

Drilling to the hourly chart below, the move higher today has seen the price move back above its 200 hour moving average at 127.427 (green line in the chart below. That level – coupled with the December low nearby at 127.384, increases the areas importance in the short term.

Stay above and the buyers can feel more confident for further upside momentum going forward. Conversely moving below and the upside bets are off.