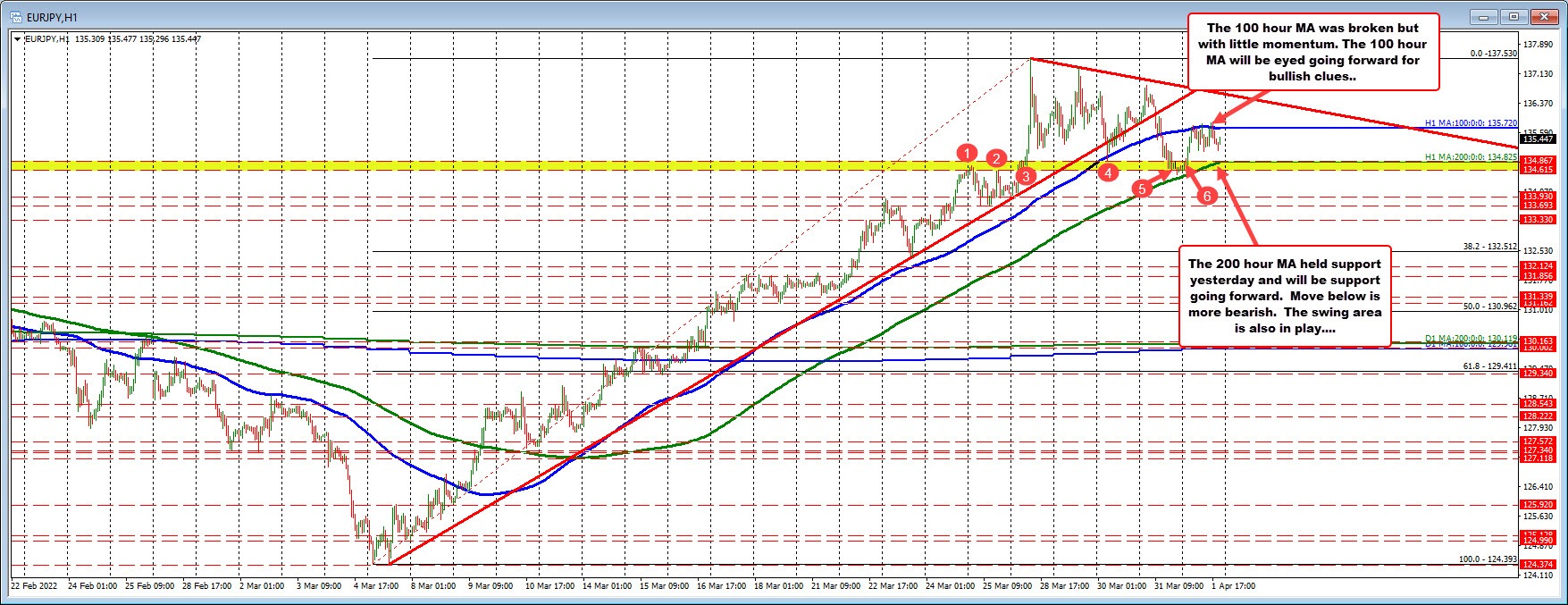

The EURJPY moved below its 100 hour MA for the first time since March 9th yesterday and moved down to test a swing area between 134.61 and 134.86, along with the rising 200 hour MA. The swing area was modestly broken, but the 200 hour MA could not and the price moved back higher in the Asian session today.

The rise today saw the price move back toward the 100 hour MA (blue line) and although the price highs took small peeks above the 100 hour MA today, the price could not sustain upside momentum. The 100 hour MA is currently at 135.72. The current price is at 135.45.

It seems the pair will likely go out between the 100 hour MA above at 135.72 and the 200 hour MA below (green line) at 134.825. That will leave the flows from next week to determine the next move in the pair.

- Move above the 100 hour MA would be more bullish.

- Move below the 200 hour MA and the bias would move more in favor in the short term to the sellers.

- Between the levels and the battle continues between buyer and sellers.