The EURCHF

EUR/CHF

EUR/CHF is the currency pair encompassing the European Union’s single currency, the euro (symbol €, code EUR), and the Swiss franc of Switzerland (code CHF). The pair’s rate indicates how many Swiss francs are needed in order to purchase one euro. For example, when the EUR/CHF is trading at 1.1000, it means 1 euro is equivalent to 1.1 Swiss francs. The euro (EUR) is the world’s second most traded currency, while the Swiss franc (CHF) is the world’s sixth most traded currency, resulting in a comparatively liquid trading pair. Swiss National Bank CrisisThe EUR/CHF is most commonly defined by the events of 15th of January, 2015 – the date on which the Swiss National Bank (SNB) decided to lift the cap imposed on the Swiss Franc from 2011.This was set to a maximum of just over 0.83 euros, meaning the EUR/CHF would not be allowed to fall below 1.2. The reason why the cap was imposed in the first place was sparked by the Eurozone debt crisis.The Swiss government feared rising investment into their national currency was hampering its economy and exports, with the SNB explaining: “The minimum exchange rate was introduced during a period of exceptional overvaluation of the Swiss franc and an extremely high level of uncertainty on the financial markets. This exceptional and temporary measure protected the Swiss economy from serious harm.” At the start of 2015, the SNB decided their franc was in a much healthier environment, and not as overvalued as previously – resulting in the decision to abandon the euro peg, thereby sending the EUR/CHF smashing the 1.2 level.The crash caused immense losses to both traders and forex brokers, with lots of brokers going out of business.Perhaps the most high-profile casualties being Alpari UK, along with FXCM and its subsequent bailout. For those brokers that survived, they had to no choice but to cease trading on all CHF pairs. With the euro peg was in place, it was not uncommon for traders to use this to their advantage, buying EUR/CHF as price neared 1.2000 levels. Traditionally, EUR/CHF is seen as a decent candidate for scalping, due to its relatively predictable price action (SNB flash crash notwithstanding), and stable spread. Trading the EUR/CHF however does generally require more patience compared to other pairs, thanks to its lesser volatility.

EUR/CHF is the currency pair encompassing the European Union’s single currency, the euro (symbol €, code EUR), and the Swiss franc of Switzerland (code CHF). The pair’s rate indicates how many Swiss francs are needed in order to purchase one euro. For example, when the EUR/CHF is trading at 1.1000, it means 1 euro is equivalent to 1.1 Swiss francs. The euro (EUR) is the world’s second most traded currency, while the Swiss franc (CHF) is the world’s sixth most traded currency, resulting in a comparatively liquid trading pair. Swiss National Bank CrisisThe EUR/CHF is most commonly defined by the events of 15th of January, 2015 – the date on which the Swiss National Bank (SNB) decided to lift the cap imposed on the Swiss Franc from 2011.This was set to a maximum of just over 0.83 euros, meaning the EUR/CHF would not be allowed to fall below 1.2. The reason why the cap was imposed in the first place was sparked by the Eurozone debt crisis.The Swiss government feared rising investment into their national currency was hampering its economy and exports, with the SNB explaining: “The minimum exchange rate was introduced during a period of exceptional overvaluation of the Swiss franc and an extremely high level of uncertainty on the financial markets. This exceptional and temporary measure protected the Swiss economy from serious harm.” At the start of 2015, the SNB decided their franc was in a much healthier environment, and not as overvalued as previously – resulting in the decision to abandon the euro peg, thereby sending the EUR/CHF smashing the 1.2 level.The crash caused immense losses to both traders and forex brokers, with lots of brokers going out of business.Perhaps the most high-profile casualties being Alpari UK, along with FXCM and its subsequent bailout. For those brokers that survived, they had to no choice but to cease trading on all CHF pairs. With the euro peg was in place, it was not uncommon for traders to use this to their advantage, buying EUR/CHF as price neared 1.2000 levels. Traditionally, EUR/CHF is seen as a decent candidate for scalping, due to its relatively predictable price action (SNB flash crash notwithstanding), and stable spread. Trading the EUR/CHF however does generally require more patience compared to other pairs, thanks to its lesser volatility.

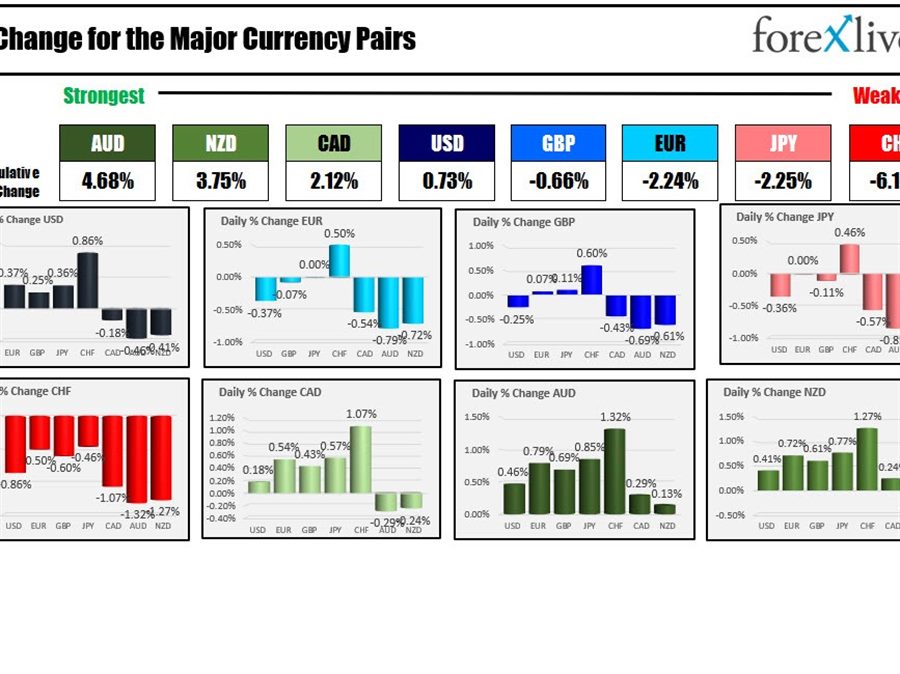

Read this Term has continued its run to the downside as investor exit the EUR

EUR

The euro (EUR) is the official currency of the European Union (EU) and 19 of 27 member states at the time of writing. It is the second most-traded currency worldwide in forex markets after the US dollar.The euro was originally introduced back on January 1, 1999, having replaced the European Currency Unit. Banknotes and physical euro coins subsequently entered circulation only in 2002.Upon its adoption, the euro replaced domestic currencies in participating EU member states. The rise in its value since then and importance in the global market has helped solidify its status as one of the most important currencies in the FX market today.Together with the USD, the currency pair is easily among the most important for forex, given its exposure into the two main economic blocs. What Factors Affects the EUR?There are several factors that affect the euro. Like most currencies, monetary policy is the most influential, which in this case refers to the European Central Bank (ECB).The ECB is responsible for regulating the monetary policy, money supply, interest rates, and relative strength of the euro. Forex traders of the euro are routinely tuned into any decision or announcements from the ECB for this reason.With 19 sovereign member states, the euro is particularly vulnerable to political developments. Recent examples include Greece’s debt crisis and Brexit, among others, which can seriously impact the euro.Finally, economic data from the bloc or from key member states such as Germany, France, Spain, and others are also closely eyed. This includes retail sales, jobless claims, Gross Domestic Product (GDP), and others.

The euro (EUR) is the official currency of the European Union (EU) and 19 of 27 member states at the time of writing. It is the second most-traded currency worldwide in forex markets after the US dollar.The euro was originally introduced back on January 1, 1999, having replaced the European Currency Unit. Banknotes and physical euro coins subsequently entered circulation only in 2002.Upon its adoption, the euro replaced domestic currencies in participating EU member states. The rise in its value since then and importance in the global market has helped solidify its status as one of the most important currencies in the FX market today.Together with the USD, the currency pair is easily among the most important for forex, given its exposure into the two main economic blocs. What Factors Affects the EUR?There are several factors that affect the euro. Like most currencies, monetary policy is the most influential, which in this case refers to the European Central Bank (ECB).The ECB is responsible for regulating the monetary policy, money supply, interest rates, and relative strength of the euro. Forex traders of the euro are routinely tuned into any decision or announcements from the ECB for this reason.With 19 sovereign member states, the euro is particularly vulnerable to political developments. Recent examples include Greece’s debt crisis and Brexit, among others, which can seriously impact the euro.Finally, economic data from the bloc or from key member states such as Germany, France, Spain, and others are also closely eyed. This includes retail sales, jobless claims, Gross Domestic Product (GDP), and others.

Read this Term and buy the relative safety of the CHF. The pair has reached a low 1.0019 and in the process is getting closer and closer to parity. The EURCHF has not traded below parity since January 2015.

The move has gotten the attention of the Swiss economy minister who says the move of the CHF close to parity is a concern. The SNB may look to curb the decline through intervention.

Drilling to the 5-minute chart below, the move lower over the last two trading days has seen the pair track mostly below the 100 bar MA on the 5 minute chart (blue line). There have been modest moves above that MA line, but the price over the last two days has stayed safely away from that MA level (green line) – keeping the seller in control and the trend intact.

Today, the pair accelerated the move to the downside. The last trend leg lower moved from 1.0125 to 1.00196. The 38.2%-50% retracement of that trend leg is between 1.0060 and 1.00726 (see yellow area in the chart below). The falling 100 bar MA is at 1.0084 currently.

It would now take a move above the retracement levels to give the buyers some form of “victory” in its battle with the sellers. Absent that, and the buyers are NOT winning. The trend remains.

Ultimately a move above the 100 bar MA would be needed to give more comfort.