EUR/USD trades to its lowest in a month, down to 1.1709 currently

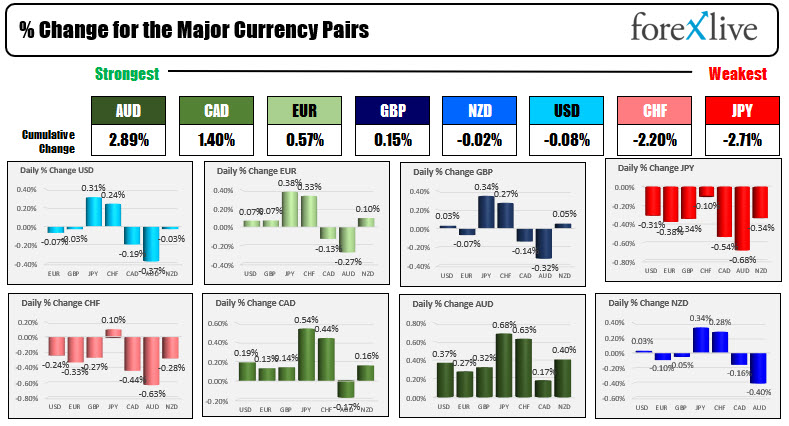

The greenback is holding firmer to start European trading as the market is honed in on the more defensive risk tone amid contagion fears surrounding China/Evergrande.

With the dollar pushing gains across the board, EUR/USD is being pressured towards 1.1700 now as sellers go in search of a third straight day of declines for the pair.

The figure level will see some bids layered but from a technical perspective, it doesn’t hold too much significance as of late. The level prevented a further droop back in April this year but sellers were able to breach through it in August before bouncing back.

For now, one can argue the 1.1700 is still a sort of key indicator of added downside momentum with the August low @ 1.1664 perhaps an insurance in case it starts to run.

Adding to the dollar tailwind this week is perhaps the Fed, with the market going to anticipate some form of acknowledgment to taper discussions at the FOMC meeting.