Quiet tones in the market to start the day again

The dollar weakened slightly in trading yesterday as risk continues to keep in a firmer spot overall, with commodity currencies seeing a decent rebound this week and US equities also closing higher once again (record closes for the S&P 500 and Nasdaq).

The bond market though is one to keep an eye out for as 10-year Treasury yields push back above 1.30% to just above 1.33% currently.

While that may in part to do with increasing optimism on the week, just be wary that taper expectations are also part of the deal when viewing the situation.

I would wager the area between 1.30% and 1.40% as a bit of a good spot for equities to thrive on the market being less worried about delta variant risks but above that, we could start to see more talk about where a taper before year-end might lead us.

That’s not always a good conversation to have for risk trades but if anything else, don’t discount the resilience of dip buyers when all is said and done.

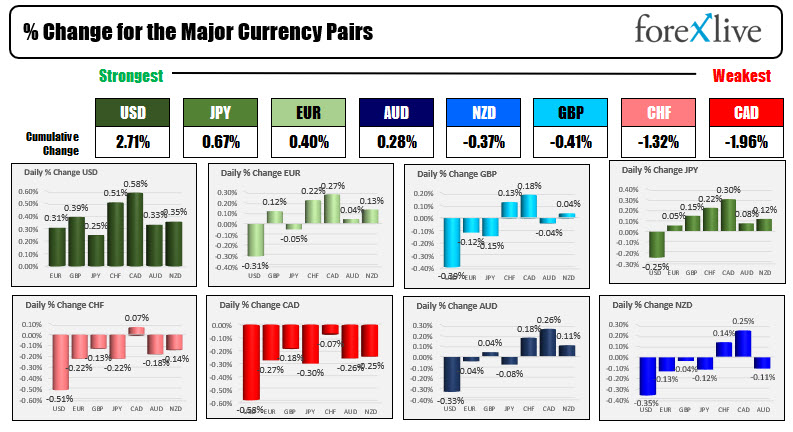

Going back to FX today, it’s a quiet start with the dollar little changed against the major currencies bloc. EUR/USD is keeping in a narrow range of just 11 pips as buyers continue to keep near-term control though I reckon gains are capped closer to 1.1800.

The antipodeans are seeing mild gains but nothing that stands out all while the loonie is a little softer as oil prices retrace some gains around its 100-day moving average for now. USD/CAD is at 1.2620 as WTI crude is down 0.8% to $67.82.