The lows today tested the low prices for the week

the price of WTI crude oil has run the gamut of the weeks highs and lows in it trading range today.

Earlier in the day, the price tested the lows for the week near the $67.56 level. The low price today reached $67.68. The high price reached $69.96. That took out the earlier week high price at $69.89. So for the day, the range was basically the range for the week.

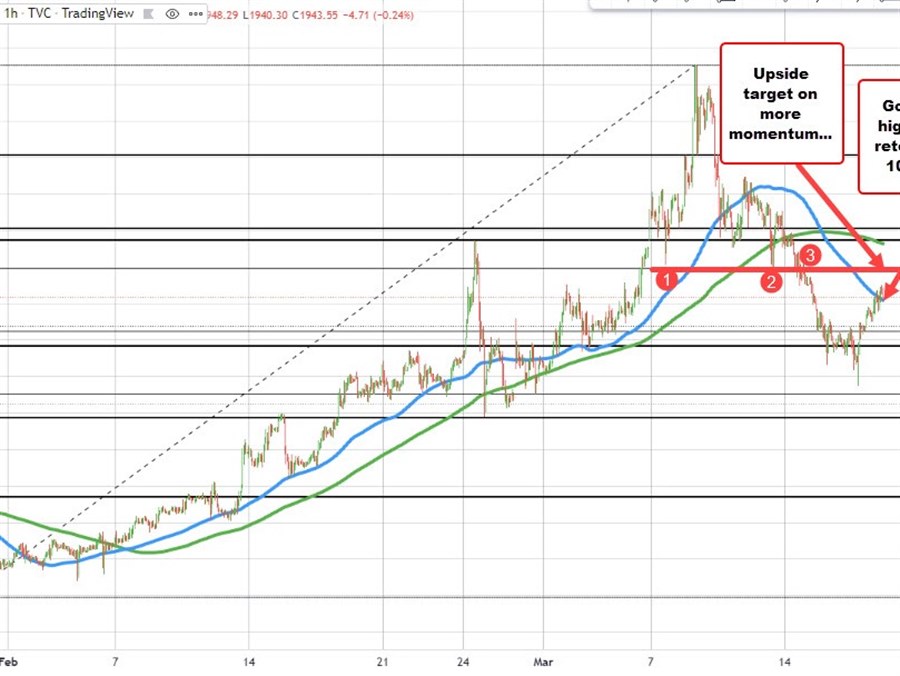

Technically, between the high and low sent the 100, 200 hour moving averages. They are currently at $68.88 and $68.94. With the price currently trading at $69.64, the price is above those moving averages which tilted the bias a little more in the favor of the buyers.

Needless to say getting above the highs for the week and then the $70 level should open the door for further upside momentum. The high prices from last week reached up near $70.53 to $70.61. Those levels would be the next targets on a break higher.

Generally speaking however, the week saw up-and-down price action with a floor and ceiling both developed.