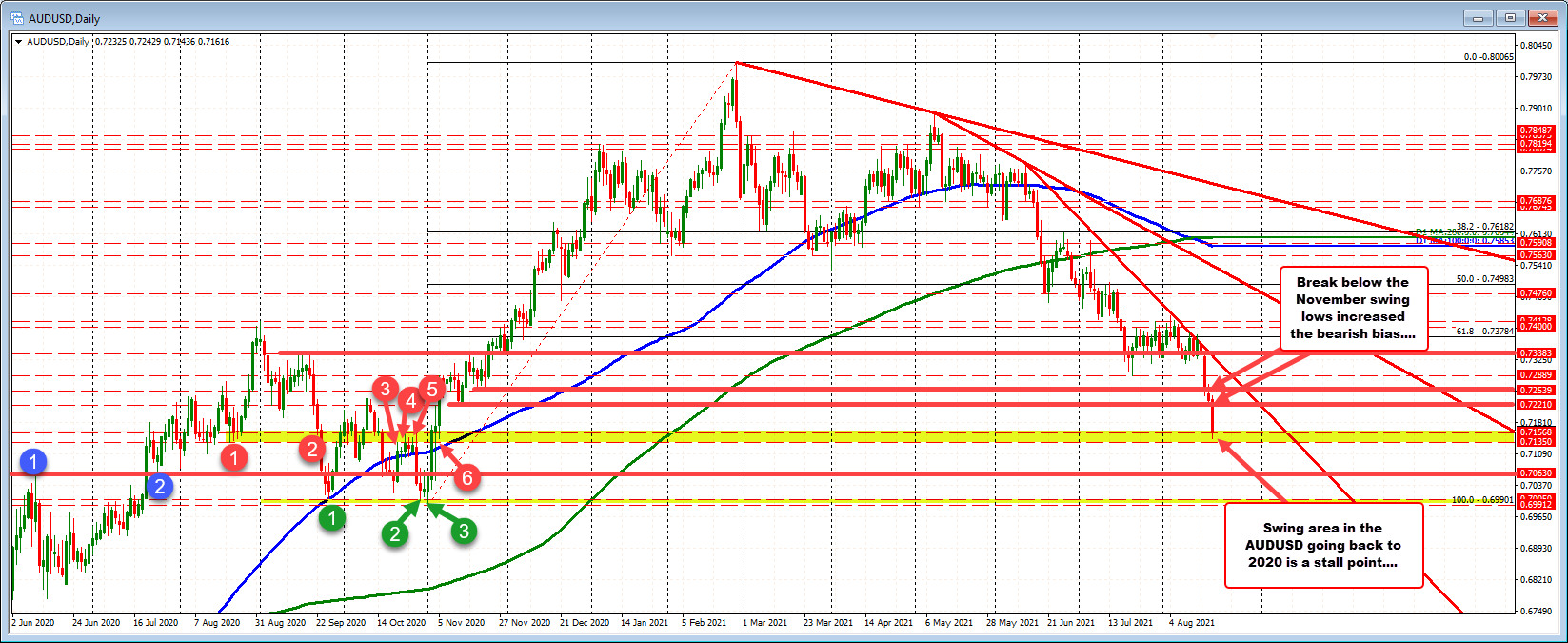

Selling enters swing area from Oct/Nov 2020 and stalls

The AUDUSD moved sharply lower today. The range is 99 pips. That is well above the 22 day average of 58 pips. The fall was helped by concerns about covid/slower growth. Technicals had a role as well.

Looking at the daily chart the price fell below the most recent lows going back to November 2020. On Tuesday, the price fell below the November 19 low at 0.72539. Today, the price moved below the November 13 low of 0.72210. Downside momentum increased.

The low price reached 0.71436. That took the price to pay swing area between 0.7135 and 0.71568. Looking back October and November 2020, there were a number of swing highs in October at that area (see red numbered circles 3 to 6) before the price started to run to the upside. Prices tend to stalled near swing areas that need to move away. That was a key swing area before the price started to trend more to the upside.

If the dip buyers are right, we should see the price start to base and move back to the upside. The risk is a move below the 0.7135 level.

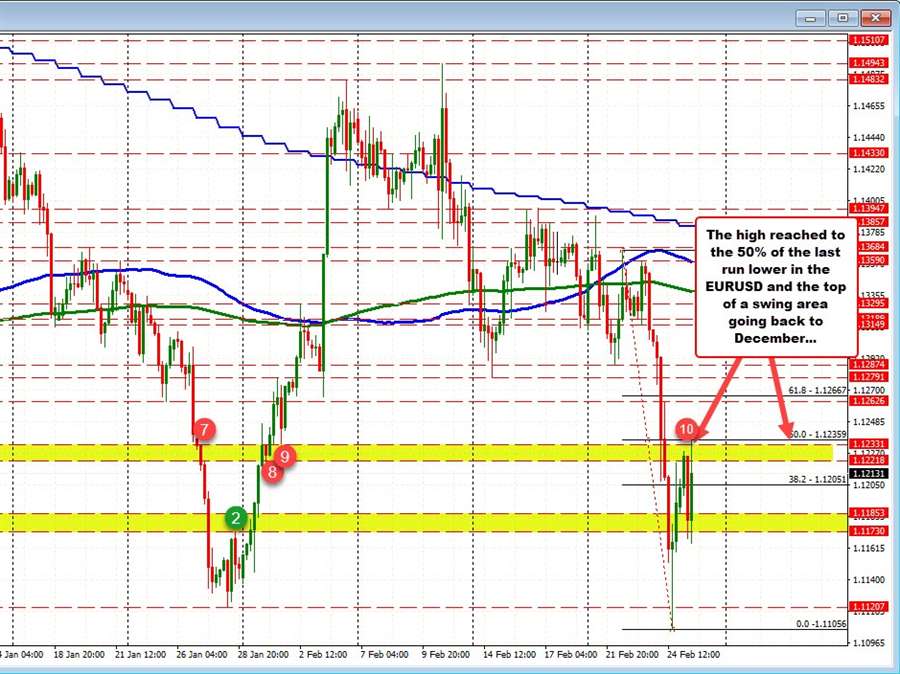

Drilling to the 5- minute chart below, the price trended in the Asian and into the early London session before bouncing off of the aforementioned support area from the daily chart. That bounce and consolidation has allowed the 100 bar moving average to catch up to the price. The price has moved above and below the 100 bar moving average indicative of a market in balance. The buyers and sellers are battling it out.

What has not happened is the price has NOT been able to get above the falling 200 bar MA (currently at 0.71796 and moving lower). If the price is to move higher, getting above the 100 and 200 bar MA would be eyed by the dip buyers. The traders will also be watching the 38.2-50% of the move down from the move down today. That area comes in at 0.7181 to 0.71929. The high corrective price stalled just below the 38.2% retracement. That is not so great for the dip buyers.

So although there is a cause for pause and a place where dip buyers can take a shot, there is work to do as well. Absent a move above the falling 200 bar MA, the sellers still are ok/the buyers are just hoping for a bounce of the daily support.