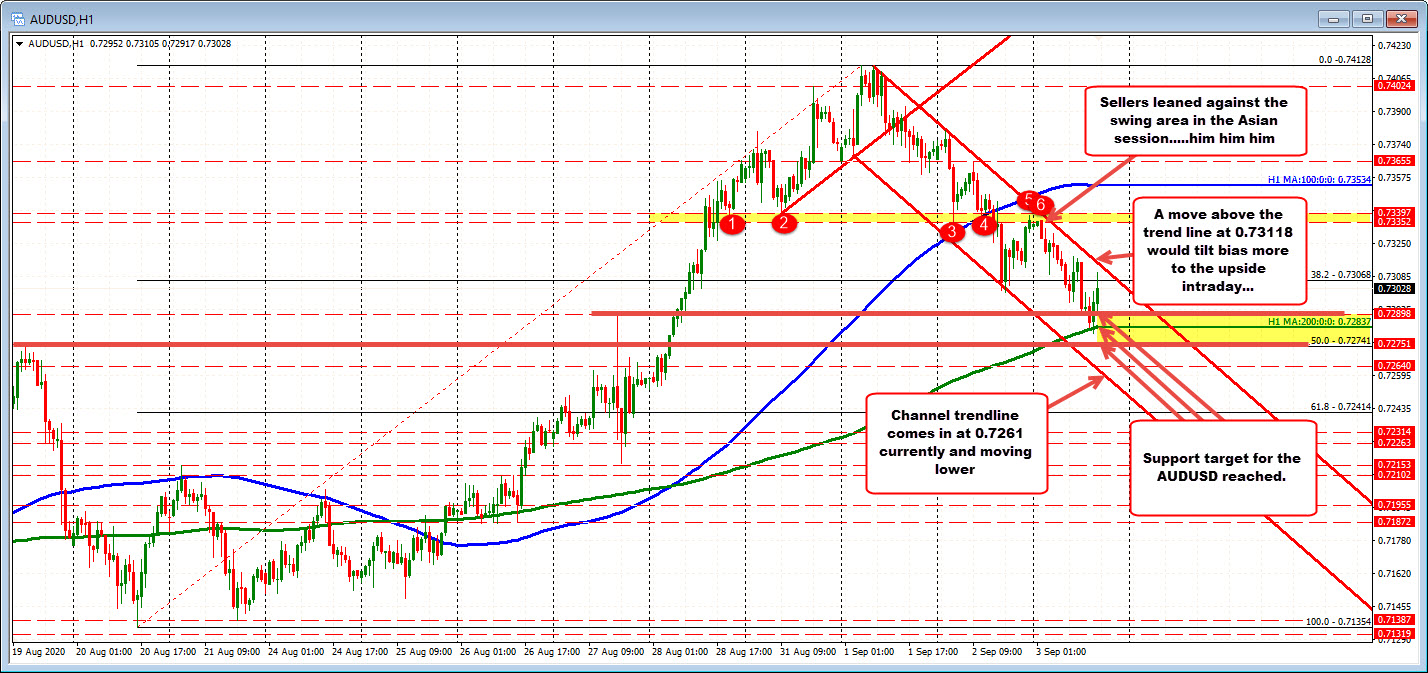

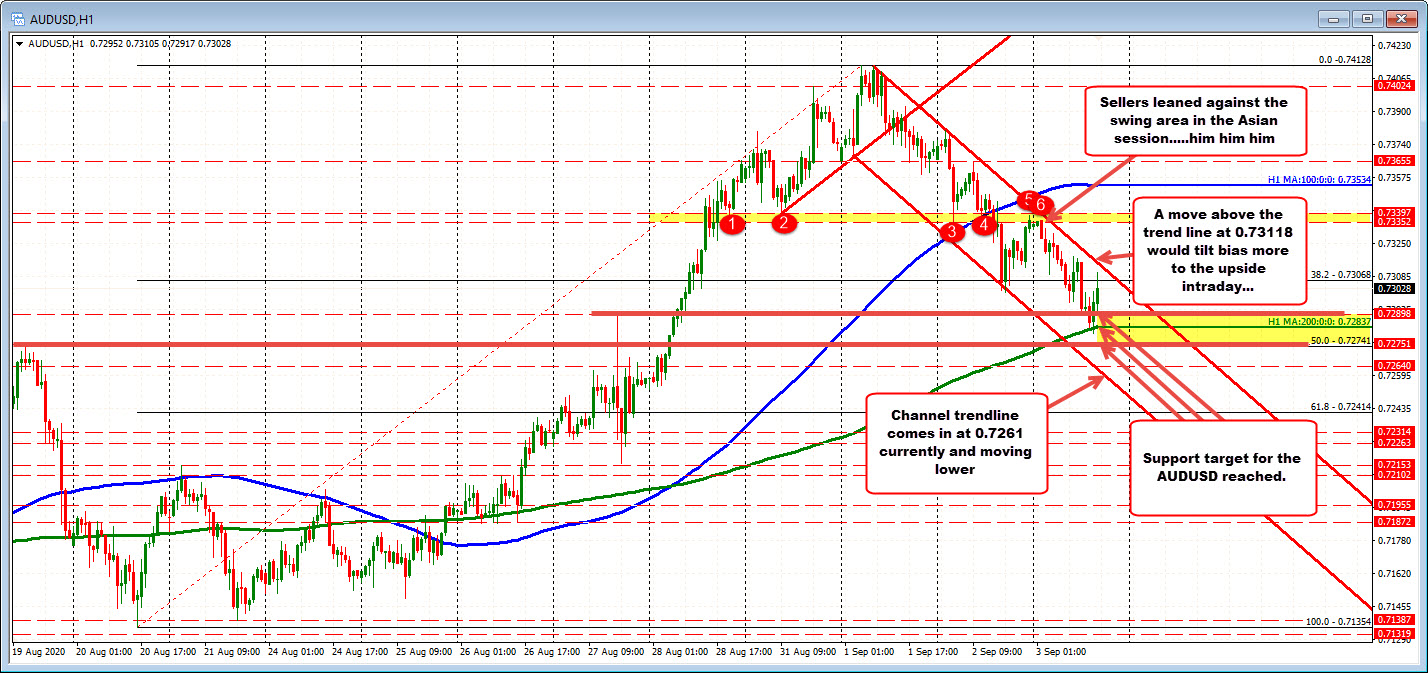

200 hour MA at 0.7284. 50% at 0.7274

The move to the downside has reached downside targets starting with the swing high from August 27 at 0.72898, and continuing to its 200 hour moving average (green line). That moving average currently comes in at 0.72843. Also in play is the 50% retracement of the move up from the August 20 low at 0.7274 (support area from 0.7274 to 0.7289).

The low price today reached 0.72805 near the middle of that area. The price has bounced back higher. The pair currently trades above and below the 0.7300 level.

There is some cause for pause against the support area. It shows a more balanced market between the buyers and sellers.

If the buyers off support today are to take more control, a move above the topside downward sloping channel trendline would be needed. That trendline currently comes in at 0.73118.

Failure to extend above that trend line, keeps the sellers more in control. A move below the 200 hour moving average and 50% retracement would have traders targeting the lower channel trend line currently at 0.7261 (and moving lower).