Covid, China growth, risk off sentiment hurting the AUDUSD

The AUDUSD is getting hit on the back of Covid, China growth, risk off sentiment as US stocks moved to new session lows.

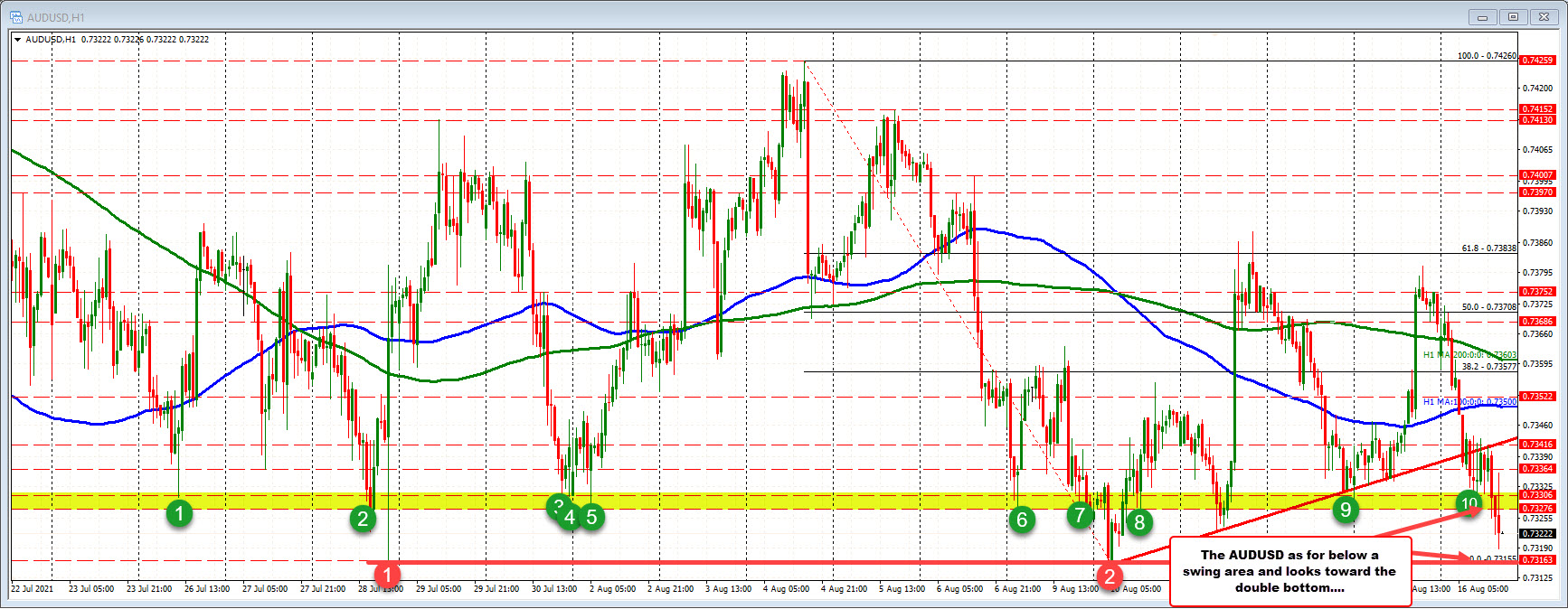

The pair trades to a new session low of 0.73188 in the last few minutes of trading. That is just above the swing lows from July 28 at 0.73163 and the low from last week’s trading at 0.73155 (close enough for a double bottom).

A move below those levels would likely see further selling momentum.

Watch the 0.73276 to a 0.73306 now as a close resistance area intraday (see green numbered circles in yellow area). That area is home to a number of swing levels going back to July 26.

In the last hourly bar, the price traded above and below the area as buyers reacted to the low near the double bottom. The pairs prices back below the area and if the sellers lean this time, it could be a “tell” that the double bottom is in jeopardy. Failure again and more dip buyers may start to dip a toe in the water (at least intraday).

- Dow -205 points

- S&P -22 points

- NASDAQ index trading near session lows at -127 points (-0.86%)