US stocks mixed with the NASDAQ leading the way

London/European traders looking to exit for the day. Below is a review of the markets.

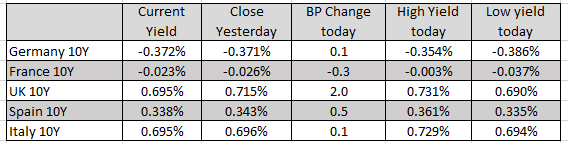

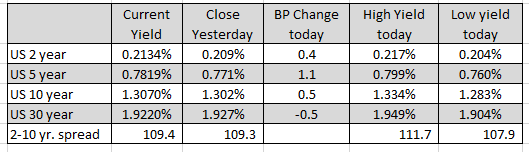

In the European debt market, the benchmark 10 year yields are mostly higher. The French 10 year yield got very close to moving back to 0.0%. It’s high yield reached -0.003% before moving back to the downside (its trading at -0.023% currently).

In other markets as the European/London traders look to exit for the day:

- Spot gold is trading up $1.28 or 0.07% at $1814.63.

- Spot silver is up $0.32 or 1.35% at $24.18

- WTI crude oil futures are trading down $0.87 or -1.28% at $67.63. OPEC + is looking to go with a 400,000 barrel per day hike in production as per expectations.

- Bitcoin is trading up $250 at $47,402

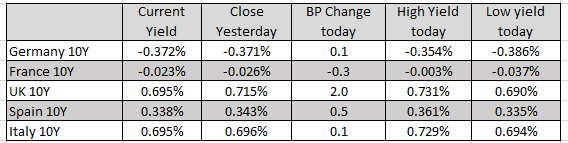

In the forex market, the AUD remains the strongest of the majors. The JPY, CAD, CHF and USD are all jockeying for the weakest of the major currencies today (the JPY is the current weakest).

In the US stock market, the NASDAQ index is outperforming. The Dow is down. The S&P is higher but only modestly. The S&P and NASDAQ are on track for record closes however:

In the US stock market, the NASDAQ index is outperforming. The Dow is down. The S&P is higher but only modestly. The S&P and NASDAQ are on track for record closes however:- Dow -47.17 points or -0.14% at 35314

- S&P index +7.62 points or 0.17% at 4530.40

- NASDAQ up 105.37 points or 0.69% at 15364.48

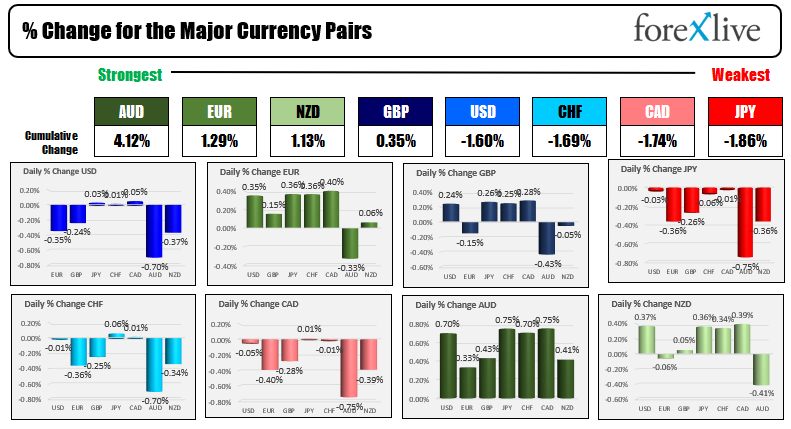

In the US debt market, yields have traded above and below unchanged. The benchmark 10 year yield is currently up 0.5 basis points at 1.3070%. It traded as high as 1.334% and as low as 1.283%.

Fundamentally,

Fundamentally,- OPEC+ is seeking to the plan to hike output by 400K bpd in October

- US construction spending was largely higher-than-expected Asians or 0.3% versus 0.2%

- ISA manufacturing came in better than expected 59.9 versus 58.6. However, employment fell below the 50 level XLIX.0. New orders were higher (66.7 versus 64.9 last month)

- The ADP employment report shocked for the second consecutive month. It came in much weaker than expected at 374K versus 640K estimate. The US jobs report will be released on Friday with expectations of a nonfarm payroll gain of 750K versus 943K last month